UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Ensysce Biosciences, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

7946 Ivanhoe Avenue, Suite 201, La Jolla, California 92037

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On December 20, 2023

To Our Stockholders:

Notice is hereby given that a special meeting of stockholders (the “Special Meeting”) of Ensysce Biosciences, Inc., a Delaware corporation (the “Company” or “Ensysce”), will be held virtually at https://agm.issuerdirect.com/ensc on December 20, 2023, at 9:00 a.m. (Pacific time), for the following purposes (which are more fully described in the proxy statement, which is attached and made a part of this Notice):

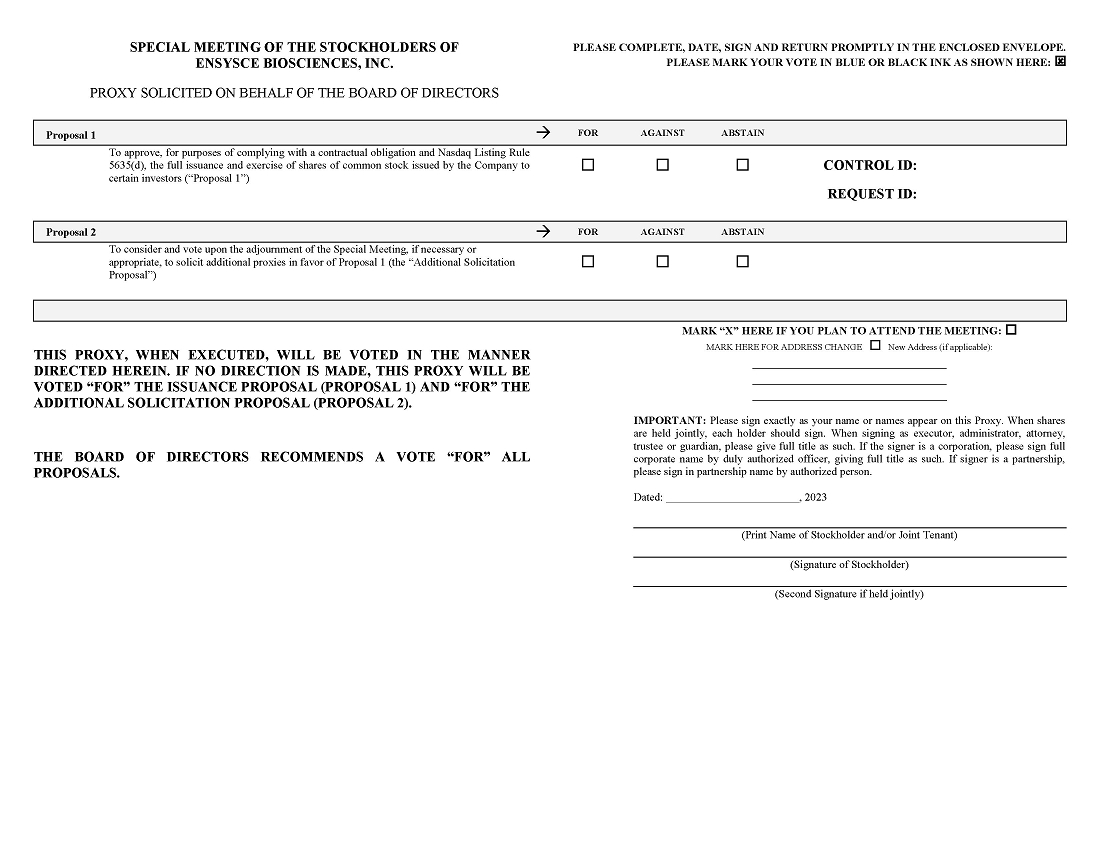

| 1. | To approve, for purposes of complying with a contractual obligation and Nasdaq Listing Rule 5635(d), the full issuance and exercise of shares of common stock issued by the Company to certain investors (“Proposal 1”). | |

| 2. | To consider and vote upon the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of Proposal 1 (the “Additional Solicitation Proposal”); and | |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Pursuant to the Amended and Restated Bylaws of the Company, no business is proper for consideration, or may be acted upon, at the Special Meeting, except as set forth in this Notice of Special Meeting of Stockholders.

The Board of Directors recommends that stockholders vote “FOR” each of Proposal 1 and the Additional Solicitation Proposal. The Board of Directors’ reasons for seeking approval of each of the proposals are set forth in the attached Proxy Statement.

Stockholders of record at the close of business on October 30, 2023 (the “Record Date”) are entitled to notice of, and to, virtually, attend and to vote at, the Special Meeting and any postponement or adjournment thereof.

The Special Meeting will be a virtual meeting. Please see “Questions and Answers about the Special Meeting and Voting — 10. How do I attend the Special Meeting?” for more information. All stockholders are cordially invited to attend the Special Meeting online by visiting https://agm.issuerdirect.com/ensc. Stockholders of record as of the Record Date may also cast their votes virtually at the Special Meeting by submitting a ballot via the live webcast. Please note that if your shares are held in the name of a bank, broker, or other nominee, and you wish to vote at the Special Meeting, you must instruct your bank, broker or other nominee how to vote your shares or you may cast your vote virtually at the special meeting by obtaining a proxy from your bank, broker or other nominee.

Whether or not you plan to attend the Special Meeting, you are encouraged to read the Proxy Statement and then cast your vote as promptly as possible in accordance with the instructions contained in the Proxy Statement. Even if you have given your proxy, you may still vote online if you follow the instructions contained in the Proxy Statement.

| By Order of the Board of Directors of | |

| Ensysce Biosciences, Inc. | |

| Sincerely, | |

| /s/ Dr. Lynn Kirkpatrick | |

| Dr. Lynn Kirkpatrick | |

| President and Chief Executive Officer |

La Jolla, California

November 10, 2023

Your vote is important, whether or not you expect to attend the Special Meeting of Stockholders. You are urged to vote either via the Internet or to mark, sign and date and promptly return the proxy in the stamped return envelope provided with such materials. Voting promptly will help avoid the additional expense of further solicitation to assure a quorum at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on December 20, 2023: This notice of meeting and the accompanying proxy statement are available at www.iproxydirect.com/ensc.

TABLE OF CONTENTS

| i |

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

November 10, 2023

PROXY STATEMENT

The following information is furnished to each stockholder in connection with the foregoing Notice of Special Meeting of Stockholders of Ensysce Biosciences, Inc. to be held virtually at https://agm.issuerdirect.com/ensc, on December 20, 2023, at 9:00 a.m. (Pacific time). The enclosed proxy is for use at the special meeting of stockholders (the “Special Meeting”) and any postponement or adjournment thereof. Unless the content requires otherwise, references to “Ensysce,” “the Company,” “we,” “our,” and “us” in this Proxy Statement refer to Ensysce Biosciences, Inc. and its subsidiaries.

In accordance with the Amended and Restated Bylaws of the Company (the “Bylaws”), the Special Meeting has been called for the following purposes:

| 1. | To approve, for purposes of complying with a contractual obligation and Nasdaq Listing Rule 5635(d), the full issuance and exercise of shares of common stock issued by the Company to certain investors (“Proposal 1”); | |

| 2. | To consider and vote upon the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of Proposal 1 (the “Additional Solicitation Proposal”); and | |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Pursuant to our Bylaws, no business is proper for consideration, or may be acted upon, at the Special Meeting, except as set forth in the Notice of Special Meeting of Stockholders.

The Special Meeting will be a virtual meeting. You will be able to attend and participate in the special meeting online by visiting https://agm.issuerdirect.com/ensc. Please see “Questions and Answers about the Special Meeting and Voting — 10. How do I attend the special meeting?” for more information.

Shares represented by duly executed and unrevoked proxies will be voted at the Special Meeting and any postponement or adjournment thereof in accordance with the specifications made therein. If no such specification is made, shares represented by duly executed and unrevoked proxies will be voted “FOR” Proposal 1 and “FOR” the Additional Solicitation Proposal.

| 1 |

Questions and Answers about the Special Meeting and Voting

| 1. | Why am I receiving these materials? |

The Company sent you this Proxy Statement and enclosed proxy card because the Board of Directors is soliciting your proxy to vote at the Special Meeting.

| 2. | What is the purpose of the Special Meeting? |

At the Special Meeting, the stockholders will act upon the matters outlined in the Notice of Special Meeting of Stockholders.

| 3. | Who can vote at the Special Meeting? |

Only stockholders of record at the close of business on October 30, 2023 (the “Record Date”). Each stockholder will be entitled to cast one vote on the proposal presented at the Special Meeting for each share of common stock that such holder owned as of the Record Date.

| 4. | What are my voting rights? |

Holders of common stock are entitled to one vote per share. As of the Record Date, a total of 3,146,076 shares of common stock were outstanding. There is no cumulative voting.

| 5. | How do I cast my vote? |

If you are a stockholder of record on the Record Date, you may vote virtually at the Special Meeting or by submitting a ballot during the live webcast or by submitting a proxy for the Special Meeting. You can authorize your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed, postage-paid envelope. Please see the answer to “— 10. How do I attend the Special Meeting?” for additional information.

If your shares of common stock are held in “street name” by a bank, broker or other nominee, you have the right to direct your bank, broker or other nominee on how to vote the shares in your account. Please see the answer to “— 10. How do I attend the Special Meeting?” for additional information.

| 6. | How do I change my vote? |

You may revoke your proxy and change your vote at any time before the final vote at the Special Meeting. You can revoke a proxy (i) by giving written revocation to the Company’s secretary, (ii) delivering an executed, later-dated proxy or (iii) voting virtually by submitting a ballot at the Special Meeting live webcast. However, your attendance at the Special Meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your proxy be revoked. If your common stock is held in street name and you wish to change or revoke your voting instructions, you should contact your financial institution for information on how to do so.

| 7. | You may vote “FOR,” “AGAINST” or “ABSTAIN” on each of the proposals. |

If you submit your proxy but abstain from voting on one or more matters, your shares will be counted as present at the meeting for the purpose of determining if a quorum exists. If you abstain from voting on a proposal, your abstention will have no effect on the outcome.

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “— 5. How do I cast my vote?” If your shares are held in street name and you do not provide voting instructions to your financial institution as described above, your financial institution does not have the discretionary authority to vote your shares regarding Proposal 1 or Proposal 2. Therefore, we encourage you to provide voting instructions to your financial institution. This ensures your shares will be voted at the Special Meeting and in the manner you desire. If your financial institution has discretionary authority to vote on any matter at the Special Meeting, a “Broker Non-Vote” will occur if your financial institution does not vote on a particular matter because it lacks discretionary authority on that matter and has not received voting instructions from you.

| 2 |

| 8. | Where and when will I be able to find the results of the voting? |

Preliminary results will be announced at the Special Meeting. The Company will publish the final results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission no later than four business days after the date of the Special Meeting.

| 9. | Where is the Special Meeting being held? |

We will hold the Special Meeting virtually at https://agm.issuerdirect.com/ensc, on December 20, 2023, at 9:00 a.m. (Pacific time), unless postponed or adjourned to a later date.

| 10. | How do I attend the Special Meeting? |

The Special Meeting will be a virtual meeting. Any stockholder wishing to attend the Special Meeting must register in advance. To register for and attend the Special Meeting, please follow these instructions as applicable to the nature of your ownership of common stock:

Record Owners. If you are a record holder and you wish to attend the Special Meeting, go to https://agm.issuerdirect.com/ensc, enter the control number you received on your proxy card or notice of the meeting and click on the “Click here to preregister for the online meeting” link at the top of the page. You will need to log back into the meeting site using your control number immediately prior to the start of the Special Meeting. You must register before the meeting starts.

Beneficial Owners. Beneficial owners who wish to attend the Special Meeting must obtain a legal proxy from the stockholder of record and e-mail a copy of their legal proxy to proxy@issuerdirect.com. Beneficial owners should contact their bank, broker, or other nominee for instructions regarding obtaining a legal proxy. Beneficial owners who e-mail a valid legal proxy will be issued a meeting control number that will allow them to register to attend and participate in the Special Meeting. You will receive an e-mail prior to the meeting with a link and instructions for entering the Special Meeting. Beneficial owners should contact Issuer Direct on or before 5:00 p.m. Eastern Time on December 18, 2023, the date that is two days prior to the Special Meeting.

TO APPROVE, FOR PURPOSES OF COMPLYING WITH A CONTRACTUAL OBLIGATION AND NASDAQ LISTING RULE 5635(D), THE FULL ISSUANCE AND EXERCISE OF SHARES OF COMMON STOCK ISSUED BY THE COMPANY TO CERTAIN INVESTORS.

Background and Overview

Securities Purchase and Security Agreement

On October 23, 2023, we and our three subsidiaries (the “Guarantors”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with an institutional investor and the chairman of our Board of Directors (the “Purchasers”), pursuant to which we agreed to issue and sell to the Purchasers and the Purchasers agreed to purchase from us (i) senior secured convertible promissory notes (the “Notes”) in an aggregate principal amount of up to $1,836,000 (the “Maximum Amount”) for an aggregate purchase price of $1.7 million and (ii) warrants to purchase shares of common stock (the “Warrants”, and together with the Notes, the “Securities”) in a private placement (the “Private Placement”). The issuance of the Notes, the Warrants and related shares of common stock issuable upon the conversion of the Notes and exercise of the Warrants are intended to be exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and the rules promulgated thereunder.

| 3 |

During 2021 and 2022, we sought and obtained approval required under Nasdaq Listing Rule 5635(d) of The Nasdaq Stock Market (“Nasdaq Listing Rule 5635(d)”) from our shareholders with respect to 2021 and 2022 transactions contemplated by securities purchase agreements and related documents, including the issuance of all shares in excess of 19.99% of our then issued and outstanding common stock. Now we are seeking shareholder approval because we are contractually obligated to do so under the Securities Purchase Agreement, rather than directly because of the requirements of Nasdaq Listing Rule 5635(d), although the rule could apply to the Notes in the future.

The Notes are secured by a pledge of substantially all of the assets, including patents and other intellectual property, of the Company and each of the Guarantors. An initial closing occurred on October 25, 2023 at which time the Company, the Guarantors, the Purchasers and an agent for the Purchasers (the “Agent”) entered into a Security Agreement (the “Security Agreement”), pursuant to which these parties granted the Purchasers, pari passu with each other Purchaser and through the Agent, a security interest in property of the Company and the Guarantors to secure the prompt payment, performance and discharge in full of all of the Company’s obligations under the Notes and the Guarantors’ obligations under a Subsidiary Guarantee (the “Subsidiary Guarantee”), a continuing security interest in all of these parties right, title and interest in and to certain property, whether presently owned or existing or hereafter acquired or coming into existence, and wherever located, as collateral security for the prompt and complete payment and performance when due of the grantor’s obligations under the Security Purchase Agreement. The Subsidiary Guarantee was entered into on October 25, 2023 by the Company and the Guarantors and provides that the Company and the Guarantors, jointly and severally, guarantee to the Purchasers the prompt and complete payment and performance of all of the liabilities and obligations that are now or in the future owed, contracted or acquired, of the Company or any Guarantor to the Purchasers, including, without limitation, all obligations under the Subsidiary Guarantee, the Notes, the Warrants, and any other related instruments, agreements or other documents. On October 25, 2023, the Company and the Guarantors also entered into a Patent Security Agreement with the Agent, pursuant to which the security interest granted by the Company and the Guarantors to the Purchasers was recorded with the United States Patent and Trademark Office.

Pursuant to the terms of the Securities Purchase Agreement, we issued and sold to the Purchasers and the Purchasers purchased from us an aggregate principal amount of $612,000 of Notes for an aggregate purchase price of $566,667 at an initial closing on October 25, 2023 (the “Initial Closing”). An additional aggregate principal amount of $1,224,000 of Notes for an aggregate purchase price of $1,133,333 will occur upon the satisfaction of certain conditions specified in the Securities Purchase Agreement (the “Second Closing”). The Second Closing may occur before our Special Meeting, and, if this occurs, it will be disclosed by means of a press release and 8-K filing. In addition, the Securities Purchase Agreement provides that upon issuance of a Note, we also issue to the Purchaser of that Note a Warrant to be exercisable for shares of common stock at a price per share equal to $1.5675, the same as the price per share of shares of common stock issuable upon conversion of that Note, subject to possible adjustment. We issued 1,255,697 Warrants on October 25, 2023 in connection with the Initial Closing.

Pursuant to the Securities Purchase Agreement, we are required to use the proceeds for working capital purposes. The Securities Purchase Agreement also includes other customary affirmative and negative covenants for transactions of this type, including a limitation on our ability to incur certain additional indebtedness. In addition, the Securities Purchase Agreement includes customary representations and warranties made by each of the Purchasers and us.

Pursuant to the terms of the Securities Purchase Agreement, until the Notes and Warrants are no longer outstanding, upon any issuance by us or any Guarantor of common stock or common stock equivalents for cash consideration, indebtedness, or a combination of units thereof (a “Subsequent Financing”), the Purchasers will have the right to participate on the same terms in up to an amount equal to 100% of the Subsequent Financing.

Notes

The Notes, subject to an original issue discount of eight percent (8%), have a term of six months and accrue interest at the rate of 6% per annum.

Under the Notes, commencing on January 25, 2024 for the Notes issued at the Initial Closing, the Company is obligated to redeem one third (33.3%) of the original principal amount under the applicable Note, plus accrued but unpaid interest, liquidated damages and any other amounts then owing to the holder of such Note. The balance of accrued but unpaid interest, liquidated damages and any other amounts then owing to the holder of such Note is due over the remainder of the Note term.

| 4 |

We are required to pay the monthly redemption amount in cash with a premium of ten percent or, at the election of a purchaser at any time, some or all of the principal amount and interest may be paid by conversion of the Note into shares of common stock. Our failure to pay any redemption amount in cash would amount to an event of default under the Notes. If any event of default occurs, the outstanding principal amount of the Notes, plus accrued but unpaid interest, liquidated damages and other amounts owing through the date of acceleration, become, at a Note holder’s election, immediately due and payable, at the Note holder’s election in cash at the Mandatory Default Amount or in shares of common stock at the Mandatory Default Amount (as defined below).

The “Mandatory Default Amount” is defined in the Notes to mean the sum of (a) the greater of (i) the outstanding principal and interest on a Note, divided by the lesser of (i) the Conversion Price, or (ii) 85% of the average of the three lowest VWAPs (as defined below) during the ten (10) consecutive trading days ending on the trading day that is immediately prior to the applicable date the Mandatory Default Amount is either (A) demanded (if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower Conversion Price, multiplied by the highest closing price for the common stock on the trading market during the period beginning on the date of first occurrence of the event of default and ending on the date the Mandatory Default Amount is paid in full, or (ii) 130% of the sum of the outstanding principal amount of a Note, plus accrued and unpaid interest, and (b) all other amounts, costs, expenses and liquidated damages due in respect of a Note. Commencing five days after an event of default that results in the eventual acceleration of the Notes, the interest rate on the Notes will increase to the lesser of 10% per annum or the maximum rate permitted under applicable law.

“VWAP” is defined in the Notes to mean, for any date, the price determined by the daily volume weighted average price of the common stock for such date (or the nearest preceding date) on The Nasdaq Stock Market. If the common stock is not then trading on The Nasdaq Stock Market, then VWAP is defined differently, depending on how the common stock is then being traded.

If we receive proceeds from any Subsequent Financings while a Note is outstanding, the Note holder may require us to first use up to 30% of the gross proceeds of the Subsequent Financing to repay the outstanding balance of such Note with a 110% premium, such amounts to be paid on a pro rata basis between the purchasers. In such event, the repayment shall be applied: first, to late fees; second, to liquidated damages; third, to accrued but unpaid interest; and fourth, to unpaid principal amounts.

The Notes may not be converted to the extent that, after giving effect to such conversion, the Purchaser, together with its affiliates and any other person acting as a group as defined pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the affiliates and such persons, the “Attribution Parties”), would beneficially own in excess of 4.99% of the number of shares of the common stock outstanding immediately prior to, and immediately after giving effect to, the conversion of all or any portion of the Notes (the “Beneficial Ownership Limitation”). The Purchasers may adjust the Beneficial Ownership limitation at any time, upon 61 days’ notice, provided that the Beneficial Ownership Limitation may not be adjusted above 9.99% of the number of shares of common stock outstanding immediately prior to, and immediately after giving effect to, the conversion of all or any portion of the Notes.

Under the terms of the Notes, if a purchaser exercises its option to be paid in shares, and we fail to deliver timely to a Holder shares due upon conversion, and if the Holder is thereafter required by its brokerage firm to purchase, or the Holder’s brokerage firm otherwise purchases, shares of common stock to deliver in satisfaction of a sale by the Holder of the shares of common stock that the Holder was entitled to receive upon such conversion, then, among other possible remedies, a Holder could require us to (A) pay in cash to the Holder the amount by which the Holder’s total purchase price for the common stock so purchased exceeds the product of (1) the aggregate shares of common stock the Holder was entitled to receive from the conversion multiplied by (2) the actual sale price at which the sell order giving rise to such purchase obligation was executed and (B) at the option of the Holder, either rescind the conversion or deliver to the Holder the number of shares of common stock that would have been issued if we had timely complied with our conversion delivery requirements.

| 5 |

Warrants

The Warrants issued in the Private Placement will be exercisable for shares of common stock, with an exercise price equal to $1.5675 per share of common stock, subject to possible adjustment. Warrants for 1,255,697 shares were issued in the Initial Closing and Warrants for 2,511,394 are expected to be issued in the Second Closing as and if that occurs. The exercise price of the Warrants is the same as the conversion price of the Notes. The Warrants have a five-year term with customary exercise blockers if ownership percentages are exceeded (mirroring the conversion blocker under the Notes if ownership percentages are exceeded) and have other customary terms, including a cashless exercise provision in the event there is no effective registration statement registering, or the prospectus contained therein is not available for the resale of, shares issuable upon exercise of Warrants and a buy-in remedy.

Registration Rights Agreement

In connection with the financing, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”) dated October 25, 2023 with the Purchasers pursuant to which we granted to the Purchasers certain demand resale registration rights with respect to the common stock issuable upon conversion of the Note, exercise of the Warrants or resulting from anti-dilution provisions in the Notes or the Warrants or any securities issued or then issuable upon any stock split, dividend or other distribution, recapitalization or similar event (the “Registrable Securities”). Pursuant to the Registration Rights Agreement we will file a registration statement covering the resale of the Registrable Securities by the Purchasers, which will occur before the Special Meeting. We, the Purchasers and certain of our and their affiliates have reciprocal indemnification obligations under the Registration Rights Agreement.

Effect of Issuance of Additional Securities

The Securities will be immediately convertible or exercisable at the discretion of a purchaser. Immediately after the Initial Closing, the Notes were convertible in full at a conversion price per share of $1.5675 and the Warrants were exercisable in full at an exercise price per share of $1.5675. These prices will also apply to Notes and Warrants issued after the Second Closing, if it occurs. As of October 30, 2023, we had 3,146,076 shares of common stock outstanding (such amount not giving effect to the exercise of any outstanding options, warrants or any other rights to purchase our securities) (the “October 30 Outstanding Share Amount”). Based on the October 30 Outstanding Share Amount:

| ● | if the Purchasers were to convert the Notes and exercise the Warrants purchased at the Initial Closing and the Second Closing in full without regard to the Beneficial Ownership Limitation at the conversion price of $1.5675 and the exercise price of $1.5675, the Purchasers would hold an aggregate of 4,938,383 shares of our common stock, equal to 157% of our outstanding common stock on a pre-transaction basis (using the October 30 Outstanding Share Amount as the denominator) and 61% of our common stock on a post-transaction basis (using 8,084,459 shares of common stock as the denominator, which includes the October 30 Outstanding Share Amount and the shares assumed issued upon conversion of the Notes and exercise of the Warrants purchased at the Initial Closing and Second Closing). |

As such, the Purchasers could significantly influence future Company decisions. We have no control over whether the Purchasers will convert the Notes or exercise the Warrants. Our stockholders will incur dilution of their percentage ownership to the extent that the Purchasers convert the Notes or exercise the Warrants. Further, if a default occurs or should the Purchasers seek a future adjustment of the conversion price and exercise price to a lower amount, stockholders would experience an even greater dilutive effect. Such a future adjustment might require shareholder approval, although we are seeking a vote on application of Nasdaq Listing Rule 5635(d) at this time to avoid the additional cost of solicitation later. The exact magnitude of the dilutive effect cannot be conclusively determined, but the dilutive effect may be material to our current stockholders.

| 6 |

Why We Need Stockholder Approval

We are seeking stockholder approval to comply with a provision in the Securities Purchase Agreement that requires us to do so and Nasdaq Listing Rule 5635(d). The Securities Purchase Agreement requires us to seek shareholder approval every four months until such time as we obtain approval or the Notes are no longer outstanding.

Until stockholder approval has been obtained, the Securities Purchase Agreement states that we cannot issue any common stock or common stock equivalents which would cause any adjustment of the conversion price to the extent the holders of Notes would not be permitted to convert their respective outstanding Notes and exercise their respective Warrants in full. A Purchaser is entitled to obtain injunctive relief against us, to preclude any such issuance. We may also be subject to damage claims because of the foregoing.

Our common stock is currently listed on the Nasdaq Capital Market and trades under the ticker symbol “ENSC”. As such, we are subject to Nasdaq Marketplace Rules. Nasdaq Listing Rule 5635(d) requires us to obtain stockholder approval prior to the sale, issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) in connection with a transaction other than a public offering at a price less than the “Minimum Price” which either alone or together with sales by officers, directors or substantial stockholders of the company equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance. For Nasdaq purposes, “Minimum Price” means a price that is the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the binding agreement. In determining whether multiple issuances should be aggregated for purposes of Nasdaq Listing Rule 5635(d), Nasdaq will consider several factors, including the timing of the issuances. Although more than 20% of our common stock may be issued in connection with the Private Placement, the Private Placement was intended to comply with the Minimum Price. However, given the possibility of issuance of additional shares of common stock in the event we are required to pay a “Mandatory Default Amount” as defined above, or in the event we are otherwise required to amend the Securities Purchase Agreement to issue additional shares of common stock following an event of default, we are seeking stockholder approval under this Proposal, to comply with Nasdaq Listing Rule 5635(d), at this time to avoid the cost of re-solicitation later.

The issuance of securities in the Private Placement, will cause a reduction in the percentage interests of our current stockholders in the voting power, any liquidation value, our book and market value, and in any future earnings. Further, the issuance or resale of our common stock issued to the Purchasers upon conversion of the Notes or exercise of the Warrants could cause the market price of our common stock to decline. In addition to the foregoing, the increase in the number of issued shares of our common stock that may be issued upon conversion of the Notes or exercise of the Warrants may have an incidental anti-takeover effect in that additional shares could be used to dilute the stock ownership of parties seeking to obtain control of us. The increased number of issued shares could discourage the possibility of, or render more difficult, certain mergers, tender offers, proxy contests or other change of control or ownership transactions.

Consequences of Not Approving this Proposal

If our stockholders do not approve this Proposal 1, we will be required to call a meeting of stockholders every four months thereafter to seek approval until the earlier of the date approval is obtained or the Notes are no longer outstanding. The requirement to seek approval at one or more additional stockholder meetings will be burdensome to the Company both in time and expense.

If our stockholders do not approve this Proposal 1, we will be unable to issue any common stock or common stock equivalents which would cause any adjustment of the conversion price to the extent the holders of Notes would not be permitted to convert their respective outstanding Notes and exercise their respective Warrants in full. A Purchaser would be entitled to obtain injunctive relief against us, to preclude any such issuance. We may also be subject to damage claims because of the foregoing.

If our stockholders do not approve this Proposal 1, and, following an event of default: (i) if additional shares of common stock are required to pay a “Mandatory Default Amount” as defined above, or (ii) we are otherwise required to issue additional shares of common stock, we would not be permitted to issue additional shares of common stock in a manner that violates Nasdaq Listing Rule 5635(d). We are seeking stockholder approval under this Proposal, to comply with our contractual obligation and Nasdaq Listing Rule 5635(d), should it apply in the future.

| 7 |

Additional Information

This summary is intended to provide you with basic information concerning the Securities Purchase Agreement, Notes and Warrants. The full text of the Securities Purchase Agreement and forms of notes and warrants was included in exhibits to our Current Report on Form 8-K filed with the SEC on October 24, 2023.

Additional Board Rationale

The Private Placement was approved by the Board. The Board determined that Proposal 1 is advisable and in the best interest of our stockholders and recommended that our stockholders vote in favor of Proposal 1. In reaching its determination to approve Proposal 1, the Board, with advice from our management and legal advisors, considered several factors, including:

| ● | we sought, but were unable to obtain, alternative financing; | |

| ● | proceeds from the Notes and Warrants that will provide the necessary working capital to enable us to continue our development plan for TAAP and MPAR® technology and our lead program PF614 and our pipeline programs PF614-MPAR and TAAP-methadone: | |

| ● | the additional and potentially substantial cash payment obligations that could arise as a result of our inability to issue shares of common stock if we do not obtain the stockholder approval that we are required to seek in connection with the Securities Purchase Agreement or we do not obtain stockholder approval that we may need to comply with Nasdaq Listing Rule 5635(d); | |

| ● | our current financial condition, results of operations, cash flow and liquidity, which require us to raise additional capital for ongoing operational needs; and |

In view of the variety of factors considered in connection with the evaluation of Proposal 1, the Board did not find it practicable to, and did not, quantify or otherwise attempt to assign any relative weight to the various factors considered. In addition, in considering the various factors, individual members of the Board may have assigned different weights to different factors.

| 8 |

Recommendation of our Board

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL, FOR PURPOSES OF COMPLYING WITH A CONTRACTUAL OBLIGATION AND NASDAQ LISTING RULE 5635(D), OF THE FULL ISSUANCE AND EXERCISE OF SHARES OF COMMON STOCK ISSUED BY THE COMPANY TO CERTAIN INVESTORS. APPROVAL OF PROPOSAL 1 ALSO GIVES THE BOARD OF DIRECTORS THE AUTHORITY TO AUTHORIZE CERTAIN SUBSEQUENT ISSUANCE(S) OF COMMON STOCK IN EXCESS OF 19.99% OF THE ISSUED AND OUTSTANDING COMMON STOCK AS A CONSEQUENCE OF CERTAIN CORPORATE ACTIONS, INCLUDING THE POSSIBLE NEGATIVE EFFECTS OF IMPLEMENTING A REVERSE STOCK SPLIT, THAT IMPACTS THE COMPANY’S OBLIGATIONS UNDER THE PRIVATE PLACEMENT.

Required Vote of Stockholders

A quorum being present, Proposal 1 requires the affirmative vote of a majority of the votes cast of our common stock present in person (including virtually) or by proxy at the Special Meeting and entitled to vote thereon as of the Record Date. Abstentions and broker non-votes will have no effect on the proposal.

ADJOURNMENT OF THE SPECIAL MEETING

If at the time of the Special Meeting, the number of shares of the Company’s common stock voting in favor of Proposal 1 is insufficient to approve it, we may move to adjourn the Special Meeting to allow us to continue to solicit additional proxies in favor of Proposal 1 for its approval.

The Board believes that it is in the best interests of the Company’s Stockholders to have Proposal 1 approved and implemented, and, therefore, enabling us to adjourn the meeting to continue to solicit proxies for Proposal 1 is advisable. The time and place of the adjourned meeting will be announced at the time the adjournment is taken. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow the Stockholders who have already sent in their proxies to revoke them at any time prior to their use at the Special Meeting as adjourned or postponed.

The Board Recommends a Vote “FOR” the Adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of Proposal 1 and proxies that are returned will be so voted unless otherwise instructed.

Required Vote of Stockholders

A quorum being present, the Additional Solicitation Proposal requires the affirmative vote of a majority of the votes cast of our common stock present in person (including virtually) or by proxy at the Special Meeting and entitled to vote thereon as of the Record Date. Abstentions and broker non-votes will have no effect on the proposal.

Recommendation of our Board

OUR BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO CONSIDER AND VOTE UPON THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES IN FAVOR OF PROPOSAL 1, AS DESCRIBED IN THIS PROPOSAL.

| 9 |

Record Date; Voting Rights and Outstanding Shares

Only holders of record of our common stock as of the close of business on October 30, 2023 are entitled to receive notice of, and to vote at, the Special Meeting. Each holder of common stock shall be entitled to one vote for each share held on all matters to be voted upon at the Special Meeting. At the close of business on the Record Date, there were 3,146,076 shares of common stock outstanding.

Holders of record who hold shares of common stock directly on the Record Date must return a proxy by one of the methods described on the proxy card or attend the Special Meeting virtually to vote on the proposals. To attend the Special Meeting, holders of record must go to https://agm.issuerdirect.com/ensc, enter the control number received on the proxy card or notice of the meeting and click on the “Click here to preregister for the online meeting” link at the top of the page. Holders of record will need to log back into the meeting site using the control number previously provided, immediately prior to the start of the Special Meeting. Holders of record must register before the Special Meeting starts.

Investors who hold shares of common stock indirectly on the Record Date (“Beneficial Holders”) through a brokerage firm, bank or other financial institution (each a “Financial Institution”) must obtain a legal proxy from the Financial Institution and e-mail a copy of the legal proxy to proxy@issuerdirect.com to have their shares voted in accordance with their instructions, as Financial Institutions do not have discretionary voting authority with respect to any of the proposals described in this Proxy Statement. Financial Institutions that do not receive voting instructions from Beneficial Holders will not be able to vote those shares. Beneficial owners should contact their bank, broker, or other nominee for instructions regarding obtaining a legal proxy. Beneficial owners who e-mail a valid legal proxy will be issued a meeting control number that will allow them to register to attend and participate in the Special Meeting. Beneficial Owners that have obtained a meeting control number will receive an e-mail prior to the meeting with a link and instructions for entering the Special Meeting. Beneficial owners should contact Issuer Direct on or before 5:00 p.m. Eastern Time on December 18, 2023, the date that is two days prior to the Special Meeting.

A quorum of stockholders is necessary to act at the Special Meeting. Stockholders representing one-third of the outstanding shares of our common stock (present in person (including virtually) or represented by proxy) will constitute a quorum. We will appoint an election inspector, who may be a Company employee, for the meeting to determine whether a quorum is present and to tabulate votes cast by proxy or in person (including virtually) at the Special Meeting. Abstentions, withheld votes and broker non-votes (which occur when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular matter because such broker, bank or other nominee does not have discretionary authority to vote on that matter and has not received voting instructions from the beneficial owner but does have discretionary authority to vote on another matter at that same meeting) are counted as present for purposes of determining the presence of a quorum for the transaction of business at the Special Meeting.

| 10 |

Votes Required for Each Proposal

To approve the proposals being considered at the Special Meeting, the voting requirements are as follows:

| Proposal | Board Recommendation |

Vote Requirement for Approval |

Effect of Abstentions |

Effect of Broker Non-Votes | ||||

| Proposal 1 | FOR |

Majority of votes cast | No effect | No effect | ||||

Additional Solicitation |

FOR | Majority of votes cast | No effect | No effect |

“Majority of votes cast” means a majority of the total votes cast on the proposal, in person or by proxy at the Special Meeting.

Your broker does not have discretion to vote on your behalf on any of the matters to be considered at the Special Meeting. If you do not provide voting instructions, your shares will not be voted on any proposal.

The vote required and method of calculation for the proposals to be considered at the Special Meeting are as follows:

Proposal 1. Approval of this proposal requires a majority of the total votes cast of the shares of our common stock present in person (including virtually) or by proxy at the Special Meeting. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. For purposes of determining whether this proposal has passed, abstentions and broker non-votes will have no effect on the proposal.

Proposal 2—Additional Solicitation Proposal. Approval of this proposal requires majority of the total votes cast of the shares of our common stock present in person (including virtually) or by proxy at the Special Meeting . You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. For purposes of determining whether this proposal has passed, abstentions and broker non-votes will have no effect on the proposal.

We request that you vote your shares by proxy following the methods as instructed by the notice: over the Internet or by mail. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the Special Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted “FOR” (1) Proposal 1; and (2) the Additional Solicitation Proposal.

Voting by Proxy Over the Internet

Stockholders whose shares are registered in their own names may vote by proxy by mail or over the Internet. Instructions for voting by proxy over the Internet are set forth on the notice of proxy materials. The Internet voting facilities will close after each proposal is addressed during the special meeting. The notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email with instructions containing a link to future proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. Certain banks and brokerage firms participate in a program that also permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this Proxy Statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers.

| 11 |

Revocability of Proxies

Any proxy may be revoked by a stockholder at any time before it is exercised by filing an instrument revoking it with the Company’s secretary or by submitting a duly executed proxy bearing a later date prior to the time of the Special Meeting. Stockholders who have voted by proxy over the Internet or by telephone or have executed and returned a proxy and who then attend the Special Meeting virtually and desire to vote in person (including virtually) are requested to notify the Company’s secretary in writing prior to the time of the Special Meeting. We request that all such written notices of revocation to the Company be addressed to David Humphrey, Secretary, c/o Ensysce Biosciences, Inc., at the address of our principal executive offices at 7946 Ivanhoe Avenue, Suite 201, La Jolla, California 92037. Our telephone number is (858) 263-4196. Stockholders may also revoke their proxy by entering a new vote over the Internet.

This solicitation is made on behalf of the Board of Directors. We will bear the costs of preparing, mailing, online processing and other costs of the proxy solicitation made by the Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the recommendations of the Board of Directors. Such solicitations may be made by telephone, facsimile transmission or personal solicitation. No additional compensation will be paid to such officers, directors or regular employees for such services. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in sending proxy material to stockholders.

OTHER MATTERS AND ADDITIONAL INFORMATION

Householding of Proxy Materials

We have adopted a procedure approved by the SEC known as “householding.” This procedure allows multiple stockholders residing at the same address the convenience of receiving a single copy of our Notice, Annual Report and proxy materials, as applicable. This allows us to save money by reducing the number of documents we must print and mail and helps protect the environment as well.

Householding is available to both registered stockholders (i.e., those stockholders with certificates registered in their name) and street name holders (i.e., those stockholders who hold their shares through a brokerage).

Registered Stockholders

If you are a registered stockholder and have consented to our mailing of proxy materials and other stockholder information only to one account in your household, as identified by you, we will deliver or mail a single copy of our Annual Report and proxy materials, as applicable, for all registered stockholders residing at the same address. Your consent will be perpetual unless you revoke it, which you may do at any time by contacting our secretary at the address of our principal executive offices at 7946 Ivanhoe Avenue, Suite 201, La Jolla, CA 92037. If you revoke your consent, we will begin sending you individual copies of future mailings of these documents within 30 days after we receive your revocation notice. If you received a household mailing this year, and you would like to receive additional copies of our Annual Report and proxy materials, as applicable, please submit your request to our Secretary at the address of our principal executive offices at 7946 Ivanhoe Avenue, Suite 201, La Jolla, California 92037, who will promptly deliver the requested copy.

| 12 |

Registered stockholders who have not consented to householding will continue to receive copies of annual reports and proxy materials for each registered stockholder residing at the same address. As a registered stockholder, you may elect to participate in householding and receive only a single copy of annual reports or proxy materials for all registered stockholders residing at the same address by contacting our secretary as outlined above.

Street Name Holders

Stockholders who hold their shares through a brokerage may elect to participate in householding or revoke their consent to participate in householding by contacting their respective brokers.

Stockholder Proposals to be Presented at the Next Annual Meeting

Any stockholder who meets the requirements of the proxy rules under the Exchange Act may submit proposals to the Board of Directors to be presented at the next annual meeting. Such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act, Delaware law and our Bylaws. If you are a stockholder and you want to include a proposal in the proxy statement for the next annual meeting in 2024, you need to provide it to Ensysce no later than 90 days, or by May 26, 2024, nor more than 120 days, or by April 26, 2024, prior to the first anniversary of the 2023 annual meeting, which is August 24, 2024. You should direct any proposals to Ensysce’s secretary at our principal office, 7946 Ivanhoe Avenue, Suite 201, La Jolla, CA 92037.

Our Bylaws also provide for separate notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting. To be considered timely under these provisions, the stockholder’s notice must be delivered to our secretary at our principal executive offices at the address set forth above (i) no later than the close of business on the ninetieth (90th) day (May 26, 2024) nor earlier than the close of business on the one hundred twentieth (120th) day (April 26, 2024) prior to the anniversary date of the prior year’s annual meeting or (ii) if the date of the annual meeting in 2024 is more than thirty (30) days before or after the anniversary date of the prior year’s annual meeting, on or before ten (10) days after the day on which the date of the annual meeting in 2024 is first disclosed in a public announcement.. The stockholder’s notice must also contain the information specified in Section 1.2 of our Bylaws.

The Board of Directors, a designated committee thereof or the chairman of the meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

| By Order of the Board of Directors of | |

| Ensysce Biosciences, Inc. | |

| Sincerely, | |

| /s/ Dr. Lynn Kirkpatrick | |

| Dr. Lynn Kirkpatrick | |

| President and Chief Executive Officer |

La Jolla, California

November 10, 2023

| 13 |