UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Ensysce Biosciences, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

7946 Ivanhoe Avenue, Suite 201

La Jolla, California 92037

(858) 263-4196

May 2, 2022

Dear Fellow Stockholder:

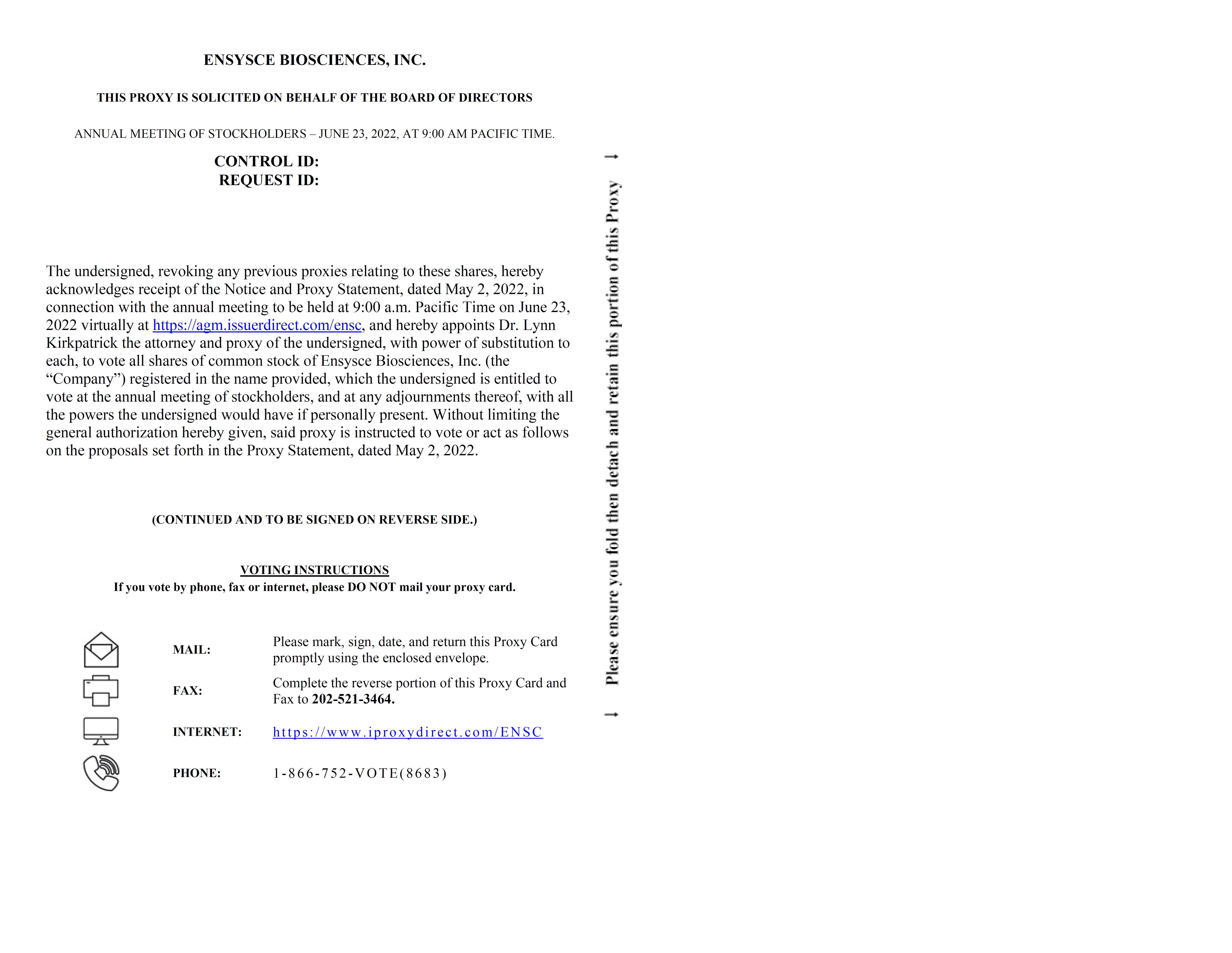

On behalf of the Board of Directors and management of Ensysce Biosciences, Inc., I cordially invite you to attend our annual meeting of stockholders on Thursday, June 23, 2022 at 9:00 a.m. (Pacific Time). The 2022 Annual Meeting will be a virtual meeting of stockholders. You will be able to attend the 2022 Annual Meeting, vote your shares electronically and submit your questions during the meeting via live webcast by visiting https://agm.issuerdirect.com/ensc. Stockholders will be able to listen, vote, and submit questions from their home or any location with internet connectivity. To participate in the meeting, you must have the 16-digit number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. The notice of meeting and proxy statement that follow describe the business that we will consider at the meeting.

We hope that you will be able to attend the meeting via our live webcast. However, regardless of whether you attend the meeting, your vote is very important. We are pleased to offer multiple options for voting your shares. You may vote via the internet, by mail or through our live webcast of the Annual Meeting, as described beginning on page two of the proxy statement.

Thank you for your continued support of Ensysce Biosciences, Inc.

| Sincerely, | |

| /s/ Dr. Lynn Kirkpatrick | |

| Dr. Lynn Kirkpatrick | |

| President and Chief Executive Officer |

| 1 |

7946 Ivanhoe Avenue, Suite 201, La Jolla, California 92037

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 23, 2022

To Our Stockholders:

Notice is hereby given that the annual meeting of stockholders (the “Annual Meeting”) of Ensysce Biosciences, Inc., a Delaware corporation (the “Company” or “Ensysce”), will be held virtually at https://agm.issuerdirect.com/ensc on June 23, 2022, at 9:00 a.m. (Pacific Time), for the following purposes (which are more fully described in the Proxy Statement, which is attached and made a part of this Notice):

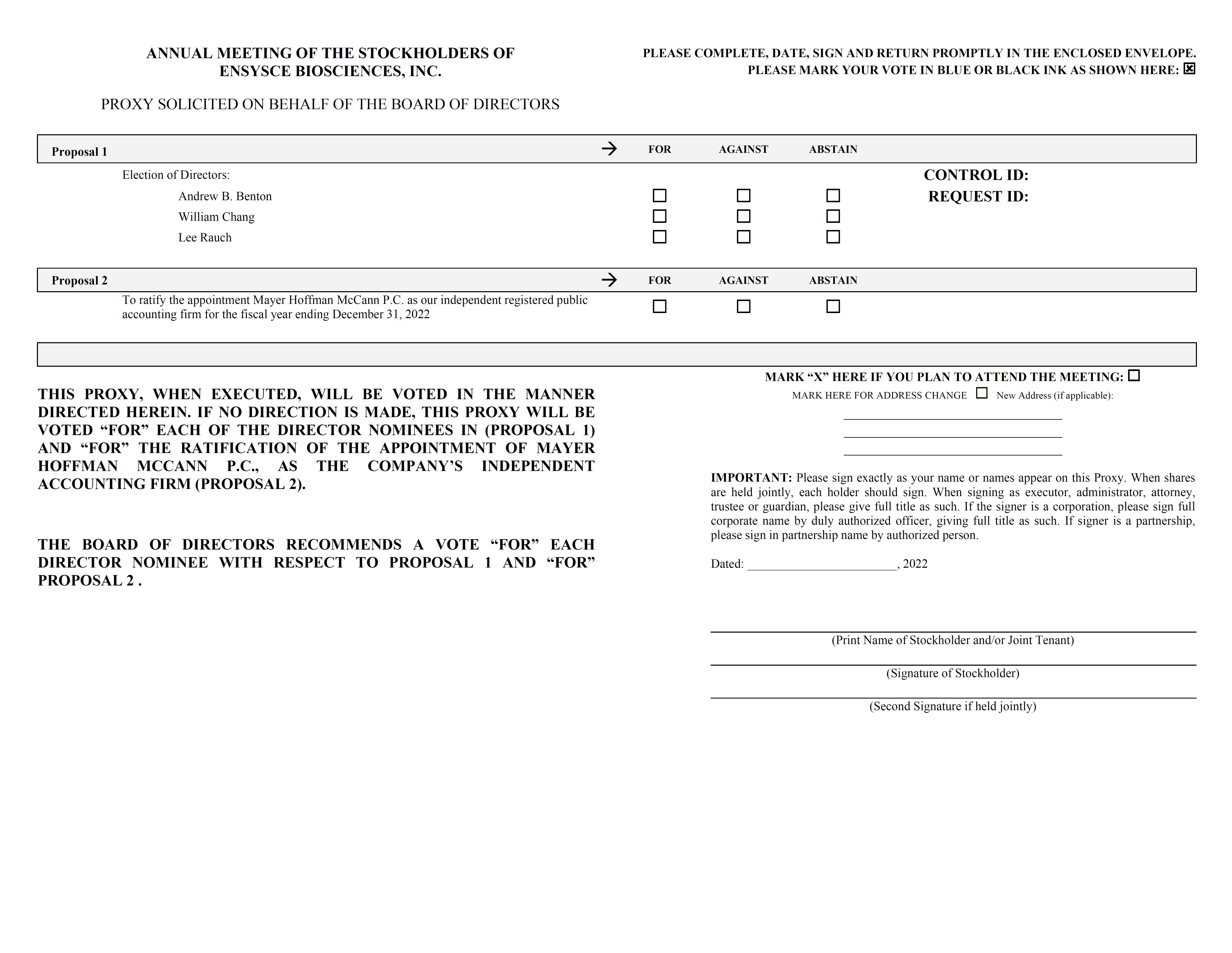

| 1. | To elect the three Class I directors named in our Proxy Statement (collectively, the “Director Nominees”) to hold office until the annual meeting of stockholders for the calendar year ended December 31, 2024 (the “2025 Annual Meeting”) and until their respective successors have been duly elected and qualified (“Proposal One”); | |

| 2. | Ratify the appointment Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (“Proposal Two”); and | |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Pursuant to the Amended and Restated Bylaws of the Company, no business is proper for consideration, or may be acted upon, at the Annual Meeting, except as set forth in this Notice of Annual Meeting of Stockholders.

Only stockholders of record as of April 29, 2022 (the “Record Date”) will be entitled to attend and vote at the Annual Meeting and any adjournments or postponements thereof. A list of these stockholders will be open for examination by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the Annual Meeting by contacting our Investor Relations specialist Shannon Devine at Shannon.devine@mzgroup.us and during the Annual Meeting at https://agm.issuerdirect.com/ensc.

Please note that if, as of the Record Date, you hold common stock in “street name” (that is, through a broker, bank or other nominee), you are considered the beneficial owner of those shares. As the beneficial owner of those shares, you have the right to direct your broker, bank or other nominee how to vote your shares. You will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares of common stock voted.

We hope that you can attend the Annual Meeting. Regardless of whether you will attend via our live webcast, please complete and return your proxy so that your shares can be voted at the Annual Meeting in accordance with your instructions.

The Board of Directors recommends that stockholders vote “FOR” each of the Director Nominees. The Board of Directors’ reasons for seeking election of the Director Nominees are set forth under “Proposal One—Election of Directors” in the attached Proxy Statement.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2022. The Board of Directors’ reasons for seeking ratification of the appointment of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2022, are set forth under “Proposal Two—Ratify Appointment of Independent Registered Public Accounting Firm” in the attached Proxy Statement.

| 2 |

Due to health concerns stemming from the COVID-19 pandemic, and to support the health and well-being of our stockholders, the Annual Meeting will be a virtual meeting. Please see “Questions and Answers about the Annual Meeting and Voting — 10. How do I attend the Annual Meeting?” for more information. All stockholders are cordially invited to attend the Annual Meeting online by visiting https://agm.issuerdirect.com/ensc. Stockholders of record as of the Record Date may also cast their votes virtually at the Annual Meeting by submitting a ballot via the live webcast. Please note that if your shares are held in the name of a bank, broker, or other nominee, and you wish to vote at the Annual Meeting, you must instruct your bank, broker or other nominee how to vote your shares or you may cast your vote virtually at the Annual Meeting by obtaining a proxy from your bank, broker or other nominee.

Whether or not you plan to attend the Annual Meeting, you are encouraged to read the Proxy Statement and then cast your vote as promptly as possible in accordance with the instructions contained in the Proxy Statement. Even if you have given your proxy, you may still vote online if you follow the instructions contained in the Proxy Statement.

| By Order of the Board of Directors of | |

| Ensysce Biosciences, Inc. | |

| Sincerely, | |

| /s/ Dr. Lynn Kirkpatrick | |

| Dr. Lynn Kirkpatrick | |

| President and Chief Executive Officer |

La Jolla, California

May 2, 2022

Your vote is important, whether or not you expect to attend the Annual Meeting of Stockholders. You are urged to vote either via the Internet at www.iproxydirect.com/ensc or to mark, sign and date and promptly return the proxy in the stamped return envelope provided with such materials. Voting promptly will help avoid the additional expense of further solicitation to assure a quorum at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 23, 2022: This notice of meeting and the accompanying proxy statement are available at www.iproxydirect.com/ensc.

| 3 |

TABLE OF CONTENTS

| i |

ENSYSCE BIOSCIENCES, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

May 2, 2022

The following information is furnished to each stockholder in connection with the foregoing Notice of Annual Meeting of Stockholders of Ensysce Biosciences, Inc. to be held virtually at https://agm.issuerdirect.com/ensc, on June 23, 2022, at 9:00 a.m. (Pacific time). The enclosed proxy is for use at the Annual Meeting of stockholders (the “Annual Meeting”) and any postponement or adjournment thereof. Unless the content requires otherwise, references to “Ensysce,” “the Company,” “we,” “our,” and “us” in this Proxy Statement refer to Ensysce Biosciences, Inc. and its subsidiaries.

In accordance with the Amended and Restated Bylaws of the Company (the “Bylaws”), the Annual Meeting has been called for the following purposes:

| 1. | To elect the three Class I directors named in our Proxy Statement (collectively, the “Director Nominees”) to hold office until the annual meeting of stockholders for the calendar year ended December 31, 2024 and until their respective successors have been duly elected and qualified (“Proposal One”); | |

| 2. | Ratify the appointment Mayer Hoffman McCann P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (“Proposal Two”); and | |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Due to health concerns stemming from the COVID-19 pandemic, and to support the health and well-being of our stockholders, the Annual Meeting will be a virtual meeting. You will be able to attend and participate in the Annual Meeting online by visiting https://agm.issuerdirect.com/ensc. Please see “Questions and Answers about the Annual Meeting and Voting — 10. How do I attend the Annual Meeting?” for more information.

Shares represented by duly executed and unrevoked proxies will be voted at the Annual Meeting and any postponement or adjournment thereof in accordance with the specifications made therein. If no such specification is made, shares represented by duly executed and unrevoked proxies will be voted “FOR” Proposal One and “FOR” Proposal Two.

Questions and Answers about the Annual Meeting and Voting

1. Why am I receiving these materials?

The Company sent you this Proxy Statement and enclosed proxy card because the Board of Directors is soliciting your proxy to vote at the Annual Meeting.

2. What is the purpose of the Annual Meeting?

At the Annual Meeting, the stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders.

3. Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 29, 2022 (the “Record Date”). Each stockholder will be entitled to cast one vote on the proposal presented at the Annual Meeting for each share of Common Stock that such holder owned as of the Record Date.

| 1 |

4. What are my voting rights?

Holders of Common Stock are entitled to one vote per share. As of the Record Date, a total of 32,011,042 shares of Common Stock were outstanding. There is no cumulative voting.

5. How do I cast my vote?

If you are a stockholder of record on the Record Date, you may vote virtually at www.iproxydirect.com/ensc, at the Annual Meeting or by submitting a ballot during the live webcast or by submitting a proxy for the Annual Meeting. You can authorize your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed, postage-paid envelope. Please see the answer to “— 10. Who can vote at the Annual Meeting?” for additional information.

If your shares of common stock are held in “street name” by a bank, broker or other nominee, you have the right to direct your bank, broker or other nominee on how to vote the shares in your account. Please see the answer to “— 10. Who can vote at the Annual Meeting?” for additional information.

6. How do I change my vote?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You can revoke a proxy (i) by giving written revocation to the Company’s secretary, (ii) delivering an executed, later-dated proxy or (iii) voting virtually by submitting a ballot at the Annual Meeting live webcast. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your proxy be revoked. If your Common Stock is held in street name and you wish to change or revoke your voting instructions, you should contact your financial institution for information on how to do so.

7. You may vote “FOR,” “AGAINST” or “ABSTAIN” on each of the proposals.

If you submit your proxy but abstain from voting on one or more matters, your shares will be counted as present at the meeting for the purpose of determining if a quorum exists. If you abstain from voting on a proposal, your abstention will have the effect of a vote against that proposal.

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “— 5. How do I cast my vote?” If your shares are held in street name and you do not provide voting instructions to your financial institution as described above, your financial institution does not have the discretionary authority to vote your shares regarding Proposal One or Proposal Two. Therefore, we encourage you to provide voting instructions to your financial institution. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “Broker Non-Vote” will occur if your financial institution does not receive instructions from you.

8. Where and when will I be able to find the results of the voting?

Preliminary results will be announced at the Annual Meeting. The Company will publish the final results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission no later than four business days after the date of the Annual Meeting.

9. Where is the Annual Meeting being held?

We will hold the Annual Meeting virtually at https://agm.issuerdirect.com/ensc, on June 23, 2022, at 9:00 a.m. (Pacific time), unless postponed or adjourned to a later date.

10. How do I attend the Annual Meeting?

Due to health concerns stemming from the COVID-19 pandemic, the Annual Meeting will be a virtual meeting. Any stockholder wishing to attend the Annual Meeting must register in advance. To register for and attend the Annual Meeting, please follow these instructions as applicable to the nature of your ownership of Common Stock:

Record Owners. If you are a record holder and you wish to attend the Annual Meeting, go to https://agm.issuerdirect.com/ensc, enter the control number you received on your proxy card or notice of the meeting and click on the “Click here to preregister for the online meeting” link at the top of the page. You will need to log back into the meeting site using your control number immediately prior to the start of the Annual Meeting. You must register before the meeting starts.

Beneficial Owners. Beneficial owners who wish to attend the Annual Meeting must obtain a legal proxy from the stockholder of record and e-mail a copy of their legal proxy to proxy@issuerdirect.com. Beneficial owners should contact their bank, broker, or other nominee for instructions regarding obtaining a legal proxy. Beneficial owners who e-mail a valid legal proxy will be issued a meeting control number that will allow them to register to attend and participate in the Annual Meeting. You will receive an e-mail prior to the meeting with a link and instructions for entering the Annual Meeting. Beneficial owners should contact Issuer Direct on or before 5:00 p.m. Eastern Time on June 21, 2022, the date that is two days prior to the Annual Meeting.

| 2 |

ELECTION OF DIRECTORS

Background and Overview

Our business and affairs are managed under the direction of the Board. Our Board consists of eight directors, which are divided into three classes (Class I, II and III) with Class I and III each consisting of three directors and Class II consisting of two directors.

Unless otherwise specified in the proxy, the shares voted pursuant thereto will be cast for each of Mr. Benton, Mr. Chang and Ms. Rauch. If, for any reason, at the time of election any of the nominees named should decline or be unable to accept his or her nomination or election, it is intended that such proxy will be voted for a substitute nominee, who would be recommended by our Board. Our Board, however, has no reason to believe that any of the nominees will be unable to serve as a director.

The following biographical information is furnished as to each nominee for election as a director and each of our directors as of April 12, 2022.

Nominees for Election to the Board of Directors for a Three-Year Term Expiring at the 2025 Annual Meeting

Andrew Benton, J.D. has served as a member of our Board since 2019. Mr. Benton was the President, Chief Executive Officer and Trustee of Pepperdine University from June 2000 to July 2019. Mr. Benton was the former chairman of both the American Council of Education, the major coordinating body for all of the nation’s higher education institutions, and the National Association of Independent Colleges and Universities. Mr. Benton is also past chair of the Association of Independent California Colleges and Universities and a member of the American Bar Association, the Council for Higher Education Accreditation, the President’s Cabinet of the West Coast Conference, the Association of Presidents of Independent Colleges and Universities, and the Los Angeles World Affairs Council. Mr. Benton holds an undergraduate degree in American studies from Oklahoma Christian University and a J.D. from Oklahoma University. Mr. Benton was awarded the Distinguished Alumnus Award by Oklahoma University. We believe that Mr. Benton’s experience governing academic and other institutions qualifies him to serve on our Board.

William Chang has served on our Board since 2016. Mr. Chang serves as Chief Executive Officer of Westlake Realty Group and Chairman of Westlake International Group where he has worked for more than 40 years. Mr. Chang runs Edge Venture Capital Fund and is a founder and the managing partner of Digikey. Mr. Chang is an investor in the San Francisco Giants, a Major League Baseball team. Mr. Chang is also a member of YPO Gold, Northern California and is the former Chairman of U.S. Rugby Football Union. He also served on the Board of the Asia Foundation and San Francisco Port and Social Services Commissions. Mr. Chang holds a Bachelor’s degree in Economics from Harvard University. We believe that Mr. Chang’s experience in corporate strategy and governance qualifies him to serve on our Board.

Lee Rauch has served on our Board since 2022. She is an experienced Chief Executive Officer and Strategy Advisor, has served both public and private companies. During her near 40-year career, Ms. Rauch successful built companies ranging in focus from pre-clinical research to advanced clinical development, took the lead in mergers and acquisitions and used her experience to secure financing for public and private biotech companies. Among her many leadership roles, Ms. Rauch, was notably a founding member of McKinsey & Co.’s International Pharmaceutical Practice and the Executive Chairman of Springboard Enterprises Health Innovation Hub. Most recently, Ms. Rauch, served as President and CEO of Viridian Therapeutics, Inc. Ms. Rauch received a B.S. in Chemistry from Arizona State University and an M.B.A. in Finance from the University of Chicago. We believe that Ms. Rauch’s biopharmaceutical industry experience and expertise qualifies her to serve on our Board.

Members of the Board of Directors Continuing in Office for a Term Expiring at the 2023 Annual Meeting of Stockholders

Bob Gower, Ph.D. has served on our Board since 2008 and presently serves as Chairman. Dr. Gower was Chief Executive Officer of Lyondell Petrochemical from 1985 through his retirement at the end of 1996. Together with Dr. Richard Smalley, Dr. Gower founded Carbon Nanotechnologies, Inc. (“CNI”) in 2000 developing fullerene carbon nanotubes for multiple applications. CNI was acquired by Unidym in 2007. Dr. Gower founded Specified Fuels and Chemicals in early 2008 and founded our company for the specific focus of using carbon nanotubes in therapeutic areas. He served on the board of directors of numerous companies, including Kirby Corporation and OmNova. Dr. Gower received his Ph.D. from the University of Minnesota. We believe that Mr. Gower’s previous board and industry experience qualifies him to serve on our Board.

| 3 |

Curtis Rosebraugh, M.D., MPH has served on our Board since 2021. He is a member of Griebel and Rosebraugh Consulting LLC since May 2018, where he is a regulatory consultant for small molecule and biological drug development. Prior to forming a consulting firm, he was employed by the Food and Drug Administration since 2000, holding the position of Director of the Office of Drug Evaluation II (“ODEII”) within the Center for Drug Evaluation and Research (“CDER”) from 2007 until his retirement in 2018, with supervisory responsibility for the evaluation of all drug products within 3 divisions: the Division of Pulmonary, Allergy and Rheumatology Products, the Division of Metabolism and Endocrinology Products and the Division of Anesthesia, Analgesia, and Addiction Products. In this position, he has overseen the development and approval of over 50 new drugs, was responsible for the planning of over 100 advisory committee meetings, led ODE II through several controversial safety issues and has received many honors and awards. Dr. Rosebraugh has been involved in the development of abuse deterrent opioid formulations and has also been involved in the development of the biosimilar program as well as many other CDER initiatives. Dr. Rosebraugh received his undergraduate degree in pharmacy in 1981, his Medical Degree in 1986 and completed a residency in Internal Medicine in 1989, all at the University of Kansas. He completed a Masters of Public Health at Johns Hopkins School of Public Health in 1999 and a Clinical Pharmacology Fellowship at Georgetown University in 2000. We believe that Dr. Rosebraugh’s regulatory experience in the biopharmaceutical industry qualifies him to serve on our Board.

Members of the Board of Directors Continuing in Office for a Term Expiring at the 2024 Annual Meeting of Stockholders

Dr. Lynn Kirkpatrick, Ph.D. has served on our Board and has been our Chief Executive Officer since 2009. Dr. Kirkpatrick has spent over 30 years in drug discovery and development, has initiated the clinical development of four novel drug candidates and now strives to bring highly novel and safe pain therapies to commercialization. She received a Doctor of Philosophy (“Ph.D.”) degree in Medicinal and Biomedicinal Chemistry at the University of Saskatchewan, completed a Post-Doctoral Fellowship at the Yale University School of Medicine, and was a tenured professor in the Department of Chemistry at the University of Regina. She co-founded ProlX Pharmaceuticals, Corp. (“ProlX”) an oncology discovery company, becoming Chief Executive Officer and successfully bringing three small molecules from discovery into clinical development, two of these her own discoveries from academia. ProlX was acquired by Biomira Inc., and Dr. Kirkpatrick became the Chief Scientific Officer of the merged company to focus on the development of oncology products and vaccines. In 2009, she co-founded PHusis Therapeutics, developing targeted small molecule precision medicines for oncology. Dr. Kirkpatrick has published extensively in the area of targeted drug discovery, abuse deterrent pain products and holds numerous patents for novel drugs and modalities. We believe Dr. Kirkpatrick is qualified to serve on our Board because of her extensive executive experience in our industry and her service as our Chief Executive Officer.

Adam S. Levin, MD, has served on our Board since 2021. He is the Vice Chair of Faculty Development for the Department of Orthopaedic Surgery at Johns Hopkins University, where he has been on faculty since 2014. He is an Associate Professor of Orthopaedic Surgery and Associate Professor of Oncology, researching treatments related to musculoskeletal oncology, while also maintaining an active clinical practice. He has served as the Associate Director of the Orthopaedic Surgery Residency Training Program since 2015, and has led novel curricular efforts through the Musculoskeletal Tumor Society and the American Academy of Orthopedic Surgeons. He has overseen Departmental Compliance since 2016, in addition to holding additional leadership roles related to billing, coding, and practice management for the Musculoskeletal Tumor Society and the American Academy of Orthopaedic Surgeons. Prior to joining Johns Hopkins University, Dr. Levin was an Assistant Professor of Orthopaedic Surgery at the Zucker School of Medicine at Hofstra University, and Attending Physician at Long Island Jewish Medical Center and North Shore University Hospital in New York between 2012 and 2014. Dr. Levin served as a subject-matter consultant to our predecessor, LACQ, during their initial review of our preclinical and Phase I clinical trial results. Dr. Levin holds a B.S. in Biology with a concentration in Animal Physiology from Cornell University, an M.D. from New York Medical College, and is currently studying at the Johns Hopkins University Carey School of Business for an M.B.A. with a specialization in Healthcare Management, Innovation, and Technology. We believe that Mr. Levin is well qualified to serve as a member of our Board based on his academic and practice experience and his knowledge of acute and chronic pain management, novel drug design, and health care operations and management.

Steve R. Martin has served as a member of our Board since 2020. Mr. Martin also currently serves as Senior Vice President and Chief Financial Officer of Armata Pharmaceuticals, Inc., a clinical development stage biotechnology company listed on New York Stock Exchange, since January 2016. Previously, Mr. Martin served as Senior Vice President and Chief Financial Officer of Applied Proteomics, Inc., a molecular diagnostics company, from December 2014 to August 2015. From June 2011 to December 2014, Mr. Martin served as Senior Vice President and Chief Financial Officer of Apricus Biosciences, Inc. (“Apricus”), a publicly traded pharmaceutical company, and served as the Interim Chief Executive Officer of Apricus from November 2012 through March 2013. Mr. Martin’s previous experience also includes 10 years with Deloitte & Touche LLP, a public accounting firm. Mr. Martin holds a Bachelor’s in Science in Accounting from San Diego State University and is a certified public accountant (inactive). We believe that Mr. Martin’s expertise in biopharmaceutical industry and accounting expertise qualifies him to serve on our Board.

There are no family relationships among any of our directors or executive officers.

| 4 |

Required Vote of Stockholders

A nominee for director shall be elected to the Board of Directors if the votes properly cast “FOR” such nominee’s election exceed the votes properly cast “AGAINST” such nominee’ election (with “ABSTENTIONS” and broker non-votes not counted as votes cast either “FOR” or “AGAINST” any director’s election).

Recommendation of our Board

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

CORPORATE GOVERNANCE

Board of Directors

Composition of the Board

Our business and affairs are managed under the direction of the Board. Our Board consists of eight directors, which are divided into three classes (Class I, II and III) with Class I and III each consisting of three directors and Class II consisting of two directors.

Director Independence

Nasdaq listing rules require that a majority of the board of directors of a company listed on Nasdaq be composed of “independent directors,” which is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship that, in the opinion of the company’s board of directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Based on information provided by each director concerning his or her background, employment and affiliations, including family relationships, the Board determined that each of Bob Gower, William Chang, Andrew Benton, Steve R. Martin, Adam S. Levin, Lee Rauch and Curtis Rosebraugh is an independent director under the Nasdaq listing rules and Rule 10A-3 of the Exchange Act. In making these determinations, the Board considered the current and prior relationships that each non-employee director has and will have with us and all other facts and circumstances that the Board deems relevant in determining independence, including the beneficial ownership of our common stock by each non- employee director (and related entities) and the transactions involving them described in the section entitled “Certain Relationships and Related Party Transactions.”

Board Committees

The standing committees of our Board consist of an audit committee, a compensation committee and a nominating and corporate governance committee. Our Board may from time to time establish other committees. Each of the committees reports to the Board.

Our president and chief executive officer and other executive officers regularly report to the non-executive directors and the audit, the compensation and the nominating and corporate governance committees to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls.

Audit Committee

We have an audit committee consisting of Steve R. Martin, who serves as the chairperson, Bob Gower and Andrew Benton. Each member of the audit committee qualifies as an independent director under the Nasdaq corporate governance standards and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has determined that Steve R. Martin qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and possesses financial sophistication, as defined under the rules of Nasdaq.

The purpose of the audit committee is to prepare the audit committee report required by the SEC to be included in our proxy statement and to assist our Board in overseeing and monitoring (1) the quality and integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) our independent registered public accounting firm’s qualifications and independence, (4) the performance of our internal audit function and (5) the performance of our independent registered public accounting firm.

Our Board adopted a written charter for the audit committee, which is be available on our website.

| 5 |

Compensation Committee

We have a compensation committee consisting of Adam Levin, who serves as the chairperson, Bob Gower, William Chang and Lee Rauch.

The purpose of the compensation committee is to assist our Board in discharging its responsibilities relating to (1) setting our compensation program and compensation of our executive officers and directors, (2) monitoring our incentive and equity-based compensation plans and (3) preparing the compensation committee report, if required to be included in our proxy statement under the rules and regulations of the SEC.

Our Board adopted a written charter for the compensation committee, which is available on our website.

Nominating and Corporate Governance Committee

We have a nominating and corporate governance committee, consisting of Lee Rauch, who serves as chairperson, Bob Gower, Steve R. Martin and Curtis Rosebraugh. The purpose of our nominating and corporate governance committee is to assist our Board in discharging its responsibilities relating to (1) identifying individuals qualified to become new Board members, consistent with criteria approved by the Board, (2) reviewing the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board select, the director nominees for the next annual meeting of stockholders, (3) identifying Board members qualified to fill vacancies on any Board committee and recommending that the Board appoint the identified member or members to the applicable committee, (4) reviewing and recommending to the Board corporate governance principles applicable to us, (5) overseeing the evaluation of the Board and management and (6) handling such other matters that are specifically delegated to the committee by the Board from time to time.

Our Board adopted a written charter for the nominating and corporate governance committee, which is available on our website.

Role of Board in Risk Oversight

The Board has extensive involvement in the oversight of risk management related to us and our business and accomplishes this oversight through the regular reporting to the Board by the audit committee. The audit committee represents the Board by periodically reviewing our accounting, reporting and financial practices, including the integrity of our financial statements, the surveillance of administrative and financial controls and our compliance with legal and regulatory requirements. Through its regular meetings with management, including the finance, legal, internal audit and information technology functions, the audit committee reviews and discuss all significant areas of our business and summarize for the Board all areas of risk and the appropriate mitigating factors. In addition, our Board receives periodic detailed operating performance reviews from management.

Meetings and Attendance

During the year ended December 31, 2021 there were six meetings of the Board, four meetings of the Audit Committee, two meetings of the Compensation Committee, and one meeting of the Nominating and Corporate Governance Committee. Each of our directors attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which they served during the period they served in 2021. Our independent directors meet regularly in executive session. All members of the Board are strongly encouraged to attend our annual meetings of stockholders. In lieu of an annual meeting of stockholders last year, LACQ held a special meeting of stockholders on June 28, 2021, to our knowledge all directors attended the meeting.

Board Leadership Structure

Our current Board leadership structure separates the positions of Chief Executive Officer and Chairperson of the Board, although we do not have a corporate policy requiring that structure. The Board believes that this separation is appropriate for the Company at this time because it allows for a division of responsibilities and a sharing of ideas between individuals having different perspectives. Our Chief Executive Officer, who is also a member of our Board, is primarily responsible for our operations and strategic direction, while our Board Chairperson, who is an independent member of the Board, is primarily focused on matters pertaining to corporate governance, including management oversight and strategic guidance. The Board believes that this is the most appropriate structure at this time but will make future determinations regarding whether or not to separate the roles of Chair and Chief Executive Officer based on then-current circumstances.

| 6 |

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines which describe the principles and practices that our Board will follow in carrying out its responsibilities. These guidelines cover a number of areas including the role, responsibilities, size and composition of the Board, director selection criteria, independence of directors, selection of Chairperson of the Board and Chief Executive Officer, director compensation, change in present job responsibility, director orientation and continuing education, lead director, term limits, Board meetings, Board committees, expectations of directors, management succession planning, evaluation of Board performance, Board compensation, and executive sessions. A copy of our corporate governance guidelines is available on our investor relations website.

Board Evaluations

Our Board is responsible for reviewing the effectiveness of the committees and reviewing our succession plans for Chief Executive Officer and other key positions.

Board Diversity Matrix

| Total Number of Directors: 8 | ||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose | |||||||||||||

| Gender Identity | ||||||||||||||||

| Directors | 2 | 6 | - | - | ||||||||||||

| Demographic Background | ||||||||||||||||

| African American or Black | - | - | - | - | ||||||||||||

| Alaskan Native or Native American | - | - | - | - | ||||||||||||

| Asian | - | 1 | - | - | ||||||||||||

| Hispanic or Latinx | - | - | - | - | ||||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||||

| White | 2 | 5 | - | - | ||||||||||||

| Two or More Races or Ethnicities | - | - | - | - | ||||||||||||

| LGBTQ+ | - | - | - | - | ||||||||||||

| Did Not Disclose Demographic Background | - | - | - | - | ||||||||||||

Code of Ethics

We adopted a code of business conduct that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer, which is available on our website. Our code of business conduct is a “code of ethics,” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our website.

Communications with our Board

Our Board has not determined that a written process for communications with the Board is necessary given the volume of communications that are received. The Board will consider stockholder questions and comments to be important and endeavor to respond promptly and appropriately, even though the Board may not respond to all stockholder inquiries directly.

| 7 |

RATIFY APPOINTMENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM

Overview

The Audit Committee of our Board appointed Mayer Hoffman McCann P.C. (“Mayer Hoffman”) as our independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ending December 31, 2022. During fiscal year 2021, Mayer Hoffman served as our independent auditor and reported on our consolidated financial statements for that year. Mayer Hoffman has been our independent auditor at all times since 2017.

The Audit Committee intends to periodically consider whether to rotate our independent auditor in order to assure continuing auditor independence. The Board and the members of the Audit Committee believe that the continued retention of Mayer Hoffman as the Company’s independent auditor for the fiscal year ending December 31, 2022 is in the best interests of the Company and its stockholders.

We expect that representatives of Mayer Hoffman will attend the Annual Meeting and will have the opportunity to make a statement if they so desire and to respond to appropriate questions.

Required Vote of Stockholders

Approval of this proposal requires the affirmative vote of a majority of the outstanding shares of our Common Stock present in person (including virtually) or by proxy at the Annual Meeting and entitled to vote thereon as of the Record Date. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. For purposes of determining whether this proposal has passed, abstentions will have the effect of a vote “AGAINST” the proposal. Broker non-votes will have no effect on the proposal.

Recommendation of our Board

OUR BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF MAYER HOFFMAN MCCANN P.C. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022.

| 8 |

AUDIT AND OTHER FEES

The following table sets forth the aggregate fees incurred for Mayer Hoffman, our independent registered accounting firm for the fiscal years ended December 30, 2021 and 2020. These fees are categorized as audit fees, audit-related fees, tax fees, and all other fees. The nature of the services provided in each category is described below the table.

| 2021 | 2020 | |||||||

| Audit Fees | $ | 529,966 | $ | 52,500 | ||||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | 5,404 | - | ||||||

| Total | $ | 535,370 | $ | 52,500 | ||||

Audit fees. Consist of fees incurred for professional services rendered for the audit of the consolidated financial statements and review of the quarterly interim consolidated financial statements. These fees also include the review of registration statements and the delivery of consents in connection with registration statements.

Audit-related fees. There were no fees billed by Mayer Hoffman for professional services rendered for audit-related services for the fiscal years ended December 31, 2021 and 2020.

Tax fees. There were no fees billed by Mayer Hoffman for tax fees for the fiscal years ended December 31, 2021 and 2020.

All other fees. There were no fees billed by Mayer Hoffman for professional services rendered for other compliance purposes for the fiscal year ended December 31, 2020.

All audit-related and other non-audit services were pre-approved by the Audit Committee, which concluded that the provision of such services by Mayer Hoffman was compatible with the maintenance of the firm’s independence in the conduct of its auditing functions.

| 9 |

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the year ended December 31, 2021 with management and Mayer Hoffman McCann P.C., the Company’s independent registered public accounting firm (“Mayer Hoffman”). In addition, the Audit Committee has discussed with Mayer Hoffman the matters required to be discussed under Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301, Communications with Audit Committees (AS 1301). The Sarbanes-Oxley Act of 2002 (“SOX”) requires certifications by the Company’s chief executive officer and chief financial officer in certain of the Company’s filings with the Securities and Exchange Commission (“SEC”). The Audit Committee discussed the review of the Company’s reporting and internal controls undertaken in connection with these certifications with the Company’s management and Mayer Hoffman. The Audit Committee also reviewed and discussed with the Company’s management and Mayer Hoffman their respective reports on internal control over financial reporting in accordance with Section 404 of SOX. The Audit Committee has further periodically reviewed such other matters as it deemed appropriate, including other provisions of SOX and rules adopted or proposed to be adopted by the SEC and Nasdaq.

The Audit Committee also has received the written communications from Mayer Hoffman regarding the auditor’s independence pursuant to the applicable requirements of the PCAOB Ethics and Independence Rule 3526, and it has reviewed, evaluated and discussed the written disclosures with Mayer Hoffman and its independence from the Company. The Audit Committee also has discussed with the Company’s management and Mayer Hoffman such other matters and received such assurances from them as it deemed appropriate.

Based on the foregoing review and discussions and relying thereon, the Audit Committee recommended to the Company’s Board of Directors the inclusion of the Company’s audited financial statements for the year ended December 31, 2021 in the Company’s Annual Report on Form 10-K for such year filed with the SEC.

THE AUDIT COMMITTEE

Steve R. Martin, Chairperson

Bob Gower

Andrew Benton

This report is not deemed to be incorporated by reference in any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this report by reference.

| 10 |

EXECUTIVE & DIRECTOR COMPENSATION

This section discusses the material components of the executive compensation program for our named executive officers (“NEOs”). Our NEOs, consisting of our principal executive officer and the next two most highly compensated executive officers, for the year ended December 31, 2021, were:

| ● | D. Lynn Kirkpatrick, Ph.D., Chief Executive Officer; | |

| ● | David Humphrey, Chief Financial Officer; and | |

| ● | Geoff Birkett, Chief Commercial Officer. |

Summary Compensation Table

The following table sets forth information concerning the compensation earned by our NEOs in respect of our fiscal years ended December 31, 2021 and December 31, 2020.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Dr. Lynn Kirkpatrick, PhD. Chief Executive Officer | 2021 | 174,149 | 114,000 | (1) | - | - | - | 288,149 | ||||||||||||||||||||

| 2020 | 155,868 | - | - | - | - | 155,868 | ||||||||||||||||||||||

David Humphrey Chief Financial Officer(2) | 2021 | 187,643 | 96,000 | (1) | - | - | 283,643 | |||||||||||||||||||||

| 2020 | - | - | - | - | - | |||||||||||||||||||||||

Geoff Birkett Chief Commercial Officer | 2021 | 135,000 | - | - | - | - | 135,000 | |||||||||||||||||||||

| 2020 | 72,000 | - | - | - | - | 72,000 | ||||||||||||||||||||||

| (1) | Amounts shown are discretionary cash bonuses earned in respect of 2021 performance and were paid in the first quarter of 2022. See “— Annual Performance-Based Bonuses” for more information regarding bonus awards made to Dr. Kirkpatrick and Mr. Humphrey for the fiscal year ended December 31, 2021. |

| (2) | Mr. Humphrey commenced employment with the Company on February 12, 2021. |

Narrative Disclosure to Summary Compensation Table

Elements of Compensation in 2021

The compensation of our NEOs generally consists of base salary, annual cash bonus opportunities and long-term incentive compensation in the form of equity awards, as described below.

Base Salary

The base salary payable to each NEO is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role, responsibilities, and contributions. Base salaries were initially set at the time each NEO commenced employment with us, are reviewed annually and may be increased based on the individual performance of the NEO, company performance, any change in the executive’s position within our business, the scope of the executive’s responsibilities and any changes thereto. As of December 31, 2021, the NEOs’ annual base salary rates were: $380,000 for Dr. Kirkpatrick, $320,000 for Mr. Humphrey and $300,000 for Mr. Birkett.

Effective March 1, 2022, the NEO’s annual base salary rates increased to $395,000 for Dr. Kirkpatrick, $330,000 for Mr. Humphrey and $305,000 for Mr. Birkett.

| 11 |

Annual Performance-Based Bonuses

Dr. Kirkpatrick and Mr. Humphrey each received a performance-based cash bonus for 2021, paid in early 2022. The Board based the bonus awards primarily on our successful completion of the merger (the “Merger”) with Leisure Acquisition Corp. (“LACQ”) with $8 million of financing, raising $15 million in additional financing through convertible notes, and continued progress on clinical trials. The Board also considered the target bonus amount of 30% of base salary for Mr. Humphrey included in his employment offer letter.

Starting in 2022, each of our NEOs’ performance-based cash bonus opportunity will be expressed as a percentage of base salary that can be achieved at a target level by meeting predetermined Company performance objectives established by the Board or the Compensation Committee. The 2022 annual bonus for Dr. Kirkpatrick is targeted at 50% of her base salary, and Mr. Humphrey and Mr. Birkett’s 2022 annual bonuses are targeted at 30% of their respective base salary.

Long-Term Equity Incentives

In 2021, the Company maintained the Ensysce Biosciences, Inc. 2021 Omnibus Incentive Plan (the “2021 Plan”) to provide equity-based incentive awards, designed to align our interests and the interests of our stockholders with those of our employees and consultants, including our NEOs. No stock or option awards were granted in 2021 to our NEOs.

Pursuant to his offer letter, Mr. Humphrey was entitled to receive a restricted stock unit award under the 2021 Plan for 50,000 shares of our common stock upon completion of the Merger. That grant was formally made on February 9, 2022, under the Ensysce Biosciences, Inc. Amended and Restated 2021 Omnibus Incentive Plan (the “2021 Amended and Restated Plan”). See “—Employment Agreements” for more information regarding this award.

On January 26, 2022, our stockholders approved the 2021 Amended and Restated Plan. All grants effectuated under predecessor equity plans were converted to grants outstanding under the 2021 Amended and Restated Plan. Additionally, in November 2021, we approved several conditional equity award grants to directors, consultants and employees, including to Mr. Humphrey, contingent on stockholder approval of the 2021 Amended and Restated Plan. These conditional awards were formally granted shortly after the 2021 Amended and Restated Plan was approved by our stockholders.

Employment Agreements with our NEOs

Dr. Lynn Kirkpatrick, Ph.D.

In September 2021, we entered into a formal employment offer letter with Dr. Kirkpatrick. The offer letter provides for Dr. Kirkpatrick’s at-will employment as our Chief Executive Officer and sets forth her annual base salary of $380,000. Additionally, the letter provides for her initial target annual bonus opportunity of up to 50% of base salary, with such bonus system and performance period commencing in 2022. The offer letter also indicates that Dr. Kirkpatrick is eligible to be granted certain stock awards under our equity incentive plan.

Dr. Kirkpatrick’s offer letter provides for severance benefits upon a termination of her employment by the Company without “cause”, or upon her resignation for “good reason”, in an amount equal to twelve (12) months of her then current base salary (ignoring any decrease in base salary that forms the basis for “good reason”); provided, however, that the payment of such benefits is subject to Dr. Kirkpatrick’s continued compliance with her obligations under her “At-Will, Confidential Information and Assignment of Inventions Agreement” and her execution of a general release of claims. Additionally, if such termination without “cause” or for “good reason” occurs within the one (1) month prior to, or during the twelve (12) month period immediately following a change in control, then all outstanding equity awards subject to time-based vesting will become fully vested on the later of Dr. Kirkpatrick’s termination date and the change in control. “Cause” and “good reason” are as defined in Dr. Kirkpatrick’s offer letter.

Dave Humphrey

In February 2021, we entered into an employment offer letter with Mr. Humphrey. The offer letter provides for Mr. Humphrey’s at-will employment as our Chief Financial Officer and sets forth his initial base salary of $6,000 per month until the completion of the Merger and an annual base salary of $320,000 thereafter. Additionally, the letter provides for his initial target annual bonus opportunity of up to 30% of his full $320,000 base salary. The offer letter also provides for a grant of restricted stock units of 50,000 Company shares, to vest over a three (3) year period, with 20,000 vesting on December 15, 2021 and 15,000 vesting on December 15, 2022 and December 15, 2023. This award of restricted stock units was formally granted on February 9, 2022, with the first 20,000 shares being immediately vested and paid. Additionally, Mr. Humphrey’s offer letter provided for the issuance of an option to purchase 1% of our fully diluted common stock, or 275,000 shares of common stock. This option was formally granted on February 4, 2022, following stockholder approval of the 2021 Amended and Restated Plan, with an exercise price of $3.13 per share (which was greater than the then-current per share price) and was set to vest over a four-year period, with 25% of the common stock underlying the option vesting on February 11, 2022 and 75% of the common stock underlying the option vesting in 36 equal monthly installments thereafter, subject to Mr. Humphrey’s continued employment.

| 12 |

Mr. Humphrey’s offer letter provides for severance benefits upon a termination of his employment by the Company without “cause”, or upon his resignation for “good reason”, in an amount equal to six (6) months of his then current base salary (ignoring any decrease in base salary that forms the basis for “good reason”); provided, however, that the payment of such benefits is subject to Mr. Humphrey’s continued compliance with his obligations under his “Confidential Information and Assignment Agreement” and his execution of a general release of claims. Additionally, if such termination without “cause” or for “good reason” occurs within the one (1) month prior to, or during the twelve (12) month period immediately following a change in control, then all outstanding equity awards subject to time-based vesting will become fully vested on the later of Mr. Humphrey’s termination date and the change in control. “Cause” and “good reason” are as defined in Mr. Humphrey’s offer letter.

Geoff Birkett

In July 2021, we entered into a formal employment offer letter with Mr. Birkett. The offer letter provides for Mr. Birkett’s at-will employment as our Chief Commercial Officer and sets forth his annual base salary of $300,000. Additionally, the letter provides for his initial target annual bonus opportunity of up to 30% of base salary, with such bonus system and performance period commencing in 2022. The offer letter also indicates that Mr. Birkett is eligible to be granted certain stock awards under our equity incentive plan following his start date.

Mr. Birkett’s offer letter provides for severance benefits upon a termination of his employment by the Company without cause, or upon his resignation for good reason, in an amount equal to three (3) months of his then current base salary (ignoring any decrease in base salary that forms the basis for “good reason”); provided, however, that the payment of such benefits is subject to Mr. Birkett’s continued compliance with his obligations under his “Confidential Information and Assignment Agreement” and his execution of a general release of claims. Additionally, if such termination without “cause” or for “good reason” occurs within the one (1) month prior to, or twelve (12) month period prior to or the twelve (12) month period immediately following a change in control, then all outstanding equity awards subject to time-based vesting will become fully vested on the later of Mr. Birkett’s termination date and the change in control. “Cause” and “good reason” are as defined in the offer letter.

At-Will, Confidential Information and Assignment of Inventions Agreement

In connection with each’s respective offer letter, Dr. Kirkpatrick, Mr. Birkett and Mr. Humphrey entered into an “At-Will, Confidential Information and Assignment of Inventions Agreement” (the “Confidentiality Agreement”). The Confidentiality Agreements include customary prohibitions against solicitation of our customers and employees, both during employment and for two (2) years following any cessation of employment. The Confidentiality Agreements also include standard provisions relating to the Company’s intellectual property rights and prohibit the executive from disclosing confidential information. The Confidentiality Agreements are incorporated by reference into the offer letters and payment of any severance benefits under each executive’s offer letter is conditioned on continued compliance with his or her Confidentiality Agreement.

Other Benefits

We currently provide welfare benefits that are available to all of our employees, including our NEOs, including health, dental, vision and group life insurance.

Prior to 2022, we maintained the Ensysce Biosciences, Inc. Retirement Trust, effective January 1, 2005, a tax-qualified profit sharing plan established for the exclusive benefit of our eligible employees. However, no employees participated in the plan as of December 31, 2021. Effective January 1, 2022, the Ensysce Biosciences, Inc. Retirement Trust, renamed the “Ensysce Biosciences, Inc. 401(k) Plan” (the “401(k) Plan”), was amended and restated. The 401(k) Plan provides eligible employees with an opportunity to save for retirement on a tax-advantaged basis and under which we are permitted to make safe harbor employer contributions. Employees’ pre-tax contributions are allocated to each participant’s individual account and are then invested in selected investment alternatives according to the participants’ directions. The 401(k) Plan is intended to be qualified under Section 401(a) of the Code, with the related trust intended to be tax exempt under Section 501(a) of the Code. Under the 401(k) Plan, we make employer contributions to all employees – regardless of an employee’s contributions (or lack thereof) – in an amount equal to 3% of the employee’s eligible compensation. Dr. Kirkpatrick and Mr. Humphrey commenced employee contributions to the 401(k) Plan at the beginning of 2022. To date, Mr. Birkett has not contributed to the 401(k) Plan.

| 13 |

We do not maintain any defined benefit pension plans or nonqualified deferred compensation plans.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information regarding outstanding equity awards held by our NEOs as of December 31, 2021.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Name | Grant Date | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares of Stock That Have Not Vested (#) | Market Value of Shares of Stock That Have Not Vested ($) | |||||||||||||||||||||

| Dr. Lynn Kirkpatrick, PhD. | 12/31/2015 | 99,950 | 0 | 3.21 | 12/1/2022 | - | - | |||||||||||||||||||||

| 12/31/2015 | 9,994 | 0 | 3.21 | 12/21/2022 | - | - | ||||||||||||||||||||||

| 1/15/2016 | 263,400 | 0 | 3.19 | 1/15/2026 | - | - | ||||||||||||||||||||||

| 1/4/2017 | 345,712 | 0 | 1.83 | 1/4/2027 | - | - | ||||||||||||||||||||||

| 2/5/2018 | 817,560 | 0 | 1.68 | 2/5/2028 | - | - | ||||||||||||||||||||||

| 3/1/2019 | 658,500 | 0 | 2.59 | 2/28/2029 | - | - | ||||||||||||||||||||||

| 3/15/2019 | 6,585 | 0 | 2.59 | 3/14/2029 | - | - | ||||||||||||||||||||||

| Dave Humphrey | - | - | - | - | - | - | - | |||||||||||||||||||||

| Geoff Birkett | 10/1/2018 | 19,755 | 0 | 2.59 | 10/1/2028 | - | - | |||||||||||||||||||||

| 3/1/2019 | 329,250 | 0 | 2.59 | 2/28/2029 | - | - | ||||||||||||||||||||||

Director Compensation

For the year ended December 31, 2021, we did not grant equity compensation to our non-employee directors for their service on our Board.

The following table provides summary information concerning compensation paid or accrued by us to or on behalf of our non-employee directors for services rendered to us as of December 31, 2021.

| Name | Fees Earned or Paid in Cash ($) | Total ($) | ||||||

| Bob Gower | 6,250 | 6,250 | ||||||

| William Chang | 1,875 | 1,875 | ||||||

| Andrew Benton | 1,875 | 1,875 | ||||||

| Steve Martin | 3,750 | 3,750 | ||||||

| Adam Levin | 2,500 | 2,500 | ||||||

| Curtis Rosebraugh | 1,875 | 1,875 | ||||||

In November of 2021, the Board approved a stock option award to purchase 20,000 shares of our common stock for each of the six (6) non-executive directors, conditioned on stockholder approval of the 2021 Amended and Restated Plan, with 100% of the option vesting on the date of the Company’s first routine annual stockholder meeting in 2022 at which directors are elected. The options were formally granted on February 4, 2022, shortly after stockholder approval of the 2021 Amended and Restated Plan. Each of these options has a ten (10) year term and an exercise price equal to $3.13 per share, which was greater than the fair market value of our common stock upon the grant date.

| 14 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Other than the agreements and arrangements described under the section entitled “Executive & Director Compensation” in this Proxy Statement and the transactions described below, since our inception, there has not been and there is not currently proposed, any transaction or series of similar transactions to which (i) we were, or will be, a participant; (ii) the amount involved exceeded, or will exceed, $120,000 or 1% of the average of our total assets at December 31, 2020 and 2021; and (iii) in which any director, executive officer, holder of 5% or more of any class of our capital stock or any member of the immediate family of, or entities affiliated with, any of the foregoing persons, had, or will have, a direct or indirect material interest.

Covistat

We own 79.2% of the issued and outstanding shares of Covistat, a clinical stage pharmaceutical company that is developing a compound utilized in our overdose protection program for the treatment of COVID-19. The other 20.8% is owned by two affiliates of Ensysce and Mucokinetica. Specifically, our Chief Executive Officer and Director, Dr. Lynn Kirkpatrick, owns 9.9%, our Chief Business Officer, Richard Wright, owns 9.9% and Mucokinetica owns 1.0%. Dr. Kirkpatrick is also Chief Executive Officer of Covistat. There is no revenue sharing agreement between us and Covistat.

Promissory Notes

Covistat holds a promissory note issued by us in the principal amount of $115,533. The note accrues simple interest at a rate of 12% until the note is paid in full. The principal amount of the note, together with accrued and unpaid interest, is payable in full on the earlier of (i) July 31, 2022 or (ii) receipt by us of an aggregate of least $5 million in gross proceeds from the sale of our securities. We may prepay the note in our sole discretion. The note is secured by 2,000 shares of Covistat’s common stock (representing 1.98% of the outstanding common stock of Covistat). The note contains customary covenants to protect Covistat’s collateral thereunder. Upon an event of default, as described in the note, the collateral shall be immediately enforceable and Covistat shall hold all rights, title and interest in the collateral and exercise any other rights, powers or remedies, authorized under the note.

Dr. Kirkpatrick and Andrew Benton, two of our directors, previously held promissory notes issued by us in the principal amount of $50,000. These notes were repaid in July 2021.

On March 16, 2021, Dr. Kirkpatrick loaned $100,000 to us and Bob Gower, our Chairman, loaned $200,000 to us and each of them was issued a promissory note. These notes were repaid in July 2021.

Convertible Notes

Bob Gower, our Chairman, held Unsecured 10% Convertible Promissory Notes of Ensysce in the aggregate amount of $2,500,000 issued on the following dates for the following amounts:

| ● | May 4, 2018 in the amount of $600,000; | |

| ● | September 14, 2018 in the amount of $1,000,000; | |

| ● | December 31, 2018 in the amount of $500,000; | |

| ● | October 17, 2019 in the amount of $100,000; | |

| ● | January 23, 2020 in the amount of $100,000; | |

| ● | March 9, 2020 in the amount of $100,000; and | |

| ● | April 15, 2020 in the amount of $100,000 (together, the “Gower Notes”). |

The Gower Notes were converted into shares of our common stock at a conversion price of $0.23 upon the consummation of the transactions contemplated by that certain Agreement and Plan of Merger, dated as of January 31, 2021, by and among the Company, LACQ and EB Merger Sub, Inc., wholly-owned subsidiary of LACQ, with the Company surviving such merger as a wholly-owned subsidiary of LACQ. Following the Merger, LACQ changed its name to Ensysce Bioscience, Inc.

| 15 |

RELATED PARTY TRANSACTION POLICY

Upon consummation of the Merger, the Board adopted a written related person transaction policy that sets forth the following policies and procedures for the review and approval or ratification of related person transactions.

An “Immediate Family Member” means a child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, sister-in-law, or any person sharing the household (other than a tenant or employee).

A “Related Party” means any (a) person who is or was (since the beginning of the last fiscal year for which we have filed a Form 10-K and proxy statement, even if they do not presently serve in that role) an executive officer, director or nominee for election as a director of the Company, (b) greater than 5% beneficial owner of the Company’s outstanding common stock, or (c) Immediate Family Member of any of the foregoing.

A “Related Person Transaction” is any Transaction involving the Company in which a Related Party has or will have a direct or indirect material interest, as determined by the Audit Committee.

A “Transaction” means any financial transaction, arrangement or relationship or any series of similar transactions, arrangements or relationships, including indebtedness and guarantees of indebtedness and transactions involving employment and similar relationships.

Under the policy, the following types of Transactions are deemed not to create or involve a material interest on the part of the Related Party, nor will they require approval or ratification, under the policy:

| ● | Transactions involving the purchase or sale of products or services in the ordinary course of business, not exceeding $50,000 or, if the Company is a “smaller reporting company” as defined under the Securities Act, if less, one percent of the average of the Company’s total assets as of December 31st for the last two completed fiscal years. | |

| ● | Transactions in which the Related Party’s interest derives solely from his or her service as a director of another corporation or organization that is a party to the Transaction. | |

| ● | Transactions in which the Related Party’s interest derives solely from his or her ownership of less than 5% of the equity interest in another person (other than a general partnership interest) which is a party to the Transaction. | |

| ● | Transactions in which the Related Party’s interest derives solely from his or her ownership of a class of equity securities of the Company and all holders of that class of equity securities received the same benefit on a pro rata basis (e.g., dividends). | |

| ● | Transactions in which the Related Party’s interest derives solely from his or her service as a director, trustee or officer (or similar position) of a not-for-profit organization or charity that receives donations from the Company, which donations are made pursuant to the Company’s matching program, as a result of contributions by employees, that is available on the same terms to all employees of the Company. | |

| ● | Compensation arrangements of any executive officer, other than an individual who is an Immediate Family Member of a Related Party, if such arrangements have been approved or recommended to the Board for approval by the Compensation Committee. | |

| ● | Director compensation arrangements, if such arrangements have been approved by the Board or the Compensation Committee of the Board. | |

| ● | Transactions with a Related Party in which the rates or charges involved in the Transaction are determined by competitive bids, or the Transaction involves the rendering of services as a common or contract carrier, or public utility, at rates or charges fixed in conformity with law or governmental authority. | |

| ● | Indemnity payments made to directors and executive officers in accordance with the Company’s then existing certificate of incorporation, bylaws and applicable laws. | |

| ● | Transactions with a Related Party involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture or similar services. |

Pursuant to its Audit Committee charter, the Audit Committee will have the responsibility to review, approve or ratify any Related Person Transactions.

| 16 |

Record Date; Voting Rights and Outstanding Shares

Only holders of record of our Common Stock as of the close of business on April 29, 2022 are entitled to receive notice of, and to vote at, the Annual Meeting. Each holder of Common Stock shall be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. At the close of business on the Record Date, there were 32,011,042 shares of Common Stock outstanding.

Holders of record who hold shares of Common Stock directly on the Record Date must return a proxy by one of the methods described on the proxy card or attend the Annual Meeting virtually in order to vote on the proposals. To attend the Annual Meeting, holders of record must go to https://agm.issuerdirect.com/ensc, enter the control number received on the proxy card or notice of the meeting and click on the “Click here to preregister for the online meeting” link at the top of the page. Holders of record will need to log back into the meeting site using the control number previously provided, immediately prior to the start of the Annual Meeting. Holders of record must register before the Annual Meeting starts.

Investors who hold shares of Common Stock indirectly on the Record Date (“Beneficial Holders”) through a brokerage firm, bank or other financial institution (each a “Financial Institution”) must obtain a legal proxy from the Financial Institution and e-mail a copy of the legal proxy to proxy@issuerdirect.com to have their shares voted in accordance with their instructions, as Financial Institutions do not have discretionary voting authority with respect to any of the proposals described in this Proxy Statement. Financial Institutions that do not receive voting instructions from Beneficial Holders will not be able to vote those shares. Beneficial owners should contact their bank, broker, or other nominee for instructions regarding obtaining a legal proxy. Beneficial owners who e-mail a valid legal proxy will be issued a meeting control number that will allow them to register to attend and participate in the Annual Meeting. Beneficial Owners that have obtained a meeting control number will receive an e-mail prior to the meeting with a link and instructions for entering the Annual Meeting. Beneficial owners should contact Issuer Direct on or before 5:00 p.m. Eastern Time on June 21, 2022, the date that is two days prior to the Annual Meeting.

A quorum of stockholders is necessary to take action at the Annual Meeting. Stockholders representing a majority of the outstanding shares of our Common Stock (present in person (including virtually) or represented by proxy) will constitute a quorum. We will appoint an election inspector, who may be a Company employee, for the meeting to determine whether a quorum is present and to tabulate votes cast by proxy or in person (including virtually) at the Annual Meeting. Abstentions, withheld votes and broker non-votes (which occur when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular matter because such broker, bank or other nominee does not have discretionary authority to vote on that matter and has not received voting instructions from the beneficial owner) are counted as present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

Votes Required for Each Proposal

The vote required and method of calculation for the proposals to be considered at the Annual Meeting are as follows:

Proposal One—Election of Directors. A nominee for director shall be elected to the Board of Directors if the votes properly cast “FOR” such nominee’s election exceed the votes properly cast “AGAINST” such nominee’ election (with “ABSTENTIONS” and broker non-votes not counted as votes cast either “FOR” or “AGAINST” any director’s election).

Proposal Two— Ratify Appointment of Independent Registered Accounting Firm. Approval of this proposal requires the affirmative vote of a majority of the outstanding shares of our Common Stock present in person (including virtually) or by proxy at the Annual Meeting and entitled to vote thereon as of the Record Date. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. For purposes of determining whether this proposal has passed, abstentions will have the effect of a vote “AGAINST” the proposal. Broker non-votes will have no effect on the proposal.

We request that you vote your shares by proxy following the methods as instructed by the notice: over the Internet or by mail. If you choose to vote by mail, your shares will be voted in accordance with your voting instructions if the proxy card is received prior to or at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, your shares will be voted “FOR” each of the nominees for Proposal One; and ‘FOR” Proposal Two.

| 17 |

Voting by Proxy Over the Internet

Stockholders whose shares are registered in their own names may vote by proxy by mail or over the Internet. Instructions for voting by proxy over the Internet are set forth on the notice of proxy materials. The Internet voting facilities will close after each proposal is addressed during the Annual Meeting. The notice will also provide instructions on how you can elect to receive future proxy materials electronically or in printed form by mail. If you choose to receive future proxy materials electronically, you will receive an email with instructions containing a link to future proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate such election.

If your shares are held in street name, the voting instruction form sent to you by your broker, bank or other nominee should indicate whether the institution has a process for beneficial holders to provide voting instructions over the Internet or by telephone. A number of banks and brokerage firms participate in a program that also permits stockholders whose shares are held in street name to direct their vote over the Internet or by telephone. If your bank or brokerage firm gives you this opportunity, the voting instructions from the bank or brokerage firm that accompany this Proxy Statement will tell you how to use the Internet or telephone to direct the vote of shares held in your account. If your voting instruction form does not include Internet or telephone information, please complete and return the voting instruction form in the self-addressed, postage-paid envelope provided by your broker. Stockholders who vote by proxy over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers.

Revocability of Proxies

Any proxy may be revoked at any time before it is exercised by filing an instrument revoking it with the Company’s secretary or by submitting a duly executed proxy bearing a later date prior to the time of the Annual Meeting. Stockholders who have voted by proxy over the Internet or by telephone or have executed and returned a proxy and who then attend the Annual Meeting virtually and desire to vote in person (including virtually) are requested to notify the Company’s secretary in writing prior to the time of the Annual Meeting. We request that all such written notices of revocation to the Company be addressed to David Humphrey, Secretary, c/o Ensysce Biosciences, Inc., at the address of our principal executive offices at 7946 Ivanhoe Avenue, Suite 201, La Jolla, California 92037. Our telephone number is (858) 263-4196. Stockholders may also revoke their proxy by entering a new vote over the Internet.

This solicitation is made on behalf of the Board of Directors. We will bear the costs of preparing, mailing, online processing and other costs of the proxy solicitation made by the Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the recommendations of the Board of Directors. Such solicitations may be made by telephone, facsimile transmission or personal solicitation. No additional compensation will be paid to such officers, directors or regular employees for such services. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in sending proxy material to stockholders.

| 18 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT