Filed by GTWY Holdings Limited pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Leisure Acquisition Corp. Commission File No.: 001-38306 Filed by GTWY Holdings Limited pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Leisure Acquisition Corp. Commission File No.: 001-38306

0 221 46 0 86 49 Disclaimer 249 209 190 211 0 211 GENERAL 35 34 This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. 34 The information contained in this presentation (the “Presentation”) has been prepared to assist interested parties in making their own evaluation with respect to the proposed transaction (the “Transaction”) between Leisure Acquisition Corp. (“LACQ”) and GTWY Holdings Limited (together with Gateway Casinos & Entertainment Limited, “Gateway” or the Company ), and for no other purpose. This Presentation is subject to updating, completion, revision, verification and further amendment. None of LACQ, Gateway, or their respective affiliates has authorized anyone to provide interested parties with additional or different information. No securities 0 121 regulatory authority has expressed an opinion about the securities discussed in this Presentation and it is an offence to claim otherwise. The information contained herein does not purport to be all-inclusive. Nothing herein shall 59 153 be deemed to constitute investment, legal, tax, financial, accounting or other advice. 113 0 In this Presentation, all amounts are in Canadian dollars, unless otherwise indicated. All references to US$ are based on the relevant exchange rate as at December 26, 2019. Any graphs, tables or other information in this Presentation demonstrating the historical or pro forma performance of Gateway or any other entity contained in this Presentation are intended only to illustrate past performance of such entities and are not necessarily indicative of 59 196 future performance of Gateway or such entities. 92 214 173 0 ADDITIONAL INFORMATION AND WHERE TO FIND IT This presentation relates to a proposed transaction between Gateway and LACQ. This presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be 125 245 any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 174 196 211 0 LACQ has filed a preliminary proxy statement / prospectus and will file a definitive proxy statement / prospectus with the SEC and will mail a definitive proxy statement / prospectus and other relevant documents to its stockholders. In addition, a Registration Statement on Form F-4 was filed with the SEC by Gateway that includes the preliminary proxy statement / prospectus and will be utilized for the registration of the securities to be issued in the proposed transaction. The definitive proxy statement / prospectus will be mailed to stockholders of LACQ as of a record date to be established for voting on the proposed transaction. Interested parties and security 205 holders of LACQ are advised to read the preliminary proxy statement, the prospectus, amendments thereto, and, when available, the definitive proxy statement / prospectus in connection with LACQ’s solicitation of 151 proxies for its stockholders’ meeting to be held to approve the proposed transaction because the proxy statement / prospectus will contain important information about the proposed transaction and the parties to it. 0 Interested investors and security holders of LACQ will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by LACQ and the Company through the website maintained by the SEC at www.sec.gov. 126 153 In addition, copies of the documents filed with the SEC by LACQ and/or the Company, when available, can be obtained free of charge on LACQ’s website at www.leisureacq.com or by directing a written request to Leisure Acquisition Corp., 250 West 57th Street, Suite 2223, New York, New York 10107 or by emailing George.Peng@hydramgmt.com; and/or by directing a written request to GTWY Holdings Limited, 100-4400 Dominion Street, 192 Burnaby, British Columbia V5G or by emailing gtwy@jcir.com. 146 PARTICIPANTS IN SOLICITATION 146 LACQ, Gateway and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from LACQ’s shareholders in connection with the proposed transaction. Information about 146 LACQ’s directors and executive officers and their ownership of LACQ’s securities is set forth in the preliminary proxy statement / prospectus filed by LACQ with the SEC on January 31, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is contained in the preliminary proxy statement / prospectus, which can be obtained free of charge from the sources indicated above. 196 0 INDUSTRY AND MARKET DATA 214 40 0 86 This Presentation has been prepared by Gateway and includes market data and other statistical information from third-party sources, including provincial gaming authorities. Although LACQ and the Company believes these third-party sources are reliable as of their respective dates, none of LACQ, the Company, or any of their respective affiliates has independently verified the accuracy or completeness of this information. Some data are also based 255 255 on the Company’s good faith estimates, which are derived from both internal sources and the third-party sources described above. None of LACQ, Gateway, any third-party source providing market data and statistical information, their respective affiliates, nor their respective directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy of such information (including 199 76 information from third-party sources). 0 0 233 117 0 47 76 138 0 221 46 0 86 49 Disclaimer 249 209 190 211 0 211 GENERAL 35 34 This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. 34 The information contained in this presentation (the “Presentation”) has been prepared to assist interested parties in making their own evaluation with respect to the proposed transaction (the “Transaction”) between Leisure Acquisition Corp. (“LACQ”) and GTWY Holdings Limited (together with Gateway Casinos & Entertainment Limited, “Gateway” or the Company ), and for no other purpose. This Presentation is subject to updating, completion, revision, verification and further amendment. None of LACQ, Gateway, or their respective affiliates has authorized anyone to provide interested parties with additional or different information. No securities 0 121 regulatory authority has expressed an opinion about the securities discussed in this Presentation and it is an offence to claim otherwise. The information contained herein does not purport to be all-inclusive. Nothing herein shall 59 153 be deemed to constitute investment, legal, tax, financial, accounting or other advice. 113 0 In this Presentation, all amounts are in Canadian dollars, unless otherwise indicated. All references to US$ are based on the relevant exchange rate as at December 26, 2019. Any graphs, tables or other information in this Presentation demonstrating the historical or pro forma performance of Gateway or any other entity contained in this Presentation are intended only to illustrate past performance of such entities and are not necessarily indicative of 59 196 future performance of Gateway or such entities. 92 214 173 0 ADDITIONAL INFORMATION AND WHERE TO FIND IT This presentation relates to a proposed transaction between Gateway and LACQ. This presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be 125 245 any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 174 196 211 0 LACQ has filed a preliminary proxy statement / prospectus and will file a definitive proxy statement / prospectus with the SEC and will mail a definitive proxy statement / prospectus and other relevant documents to its stockholders. In addition, a Registration Statement on Form F-4 was filed with the SEC by Gateway that includes the preliminary proxy statement / prospectus and will be utilized for the registration of the securities to be issued in the proposed transaction. The definitive proxy statement / prospectus will be mailed to stockholders of LACQ as of a record date to be established for voting on the proposed transaction. Interested parties and security 205 holders of LACQ are advised to read the preliminary proxy statement, the prospectus, amendments thereto, and, when available, the definitive proxy statement / prospectus in connection with LACQ’s solicitation of 151 proxies for its stockholders’ meeting to be held to approve the proposed transaction because the proxy statement / prospectus will contain important information about the proposed transaction and the parties to it. 0 Interested investors and security holders of LACQ will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by LACQ and the Company through the website maintained by the SEC at www.sec.gov. 126 153 In addition, copies of the documents filed with the SEC by LACQ and/or the Company, when available, can be obtained free of charge on LACQ’s website at www.leisureacq.com or by directing a written request to Leisure Acquisition Corp., 250 West 57th Street, Suite 2223, New York, New York 10107 or by emailing George.Peng@hydramgmt.com; and/or by directing a written request to GTWY Holdings Limited, 100-4400 Dominion Street, 192 Burnaby, British Columbia V5G or by emailing gtwy@jcir.com. 146 PARTICIPANTS IN SOLICITATION 146 LACQ, Gateway and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from LACQ’s shareholders in connection with the proposed transaction. Information about 146 LACQ’s directors and executive officers and their ownership of LACQ’s securities is set forth in the preliminary proxy statement / prospectus filed by LACQ with the SEC on January 31, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is contained in the preliminary proxy statement / prospectus, which can be obtained free of charge from the sources indicated above. 196 0 INDUSTRY AND MARKET DATA 214 40 0 86 This Presentation has been prepared by Gateway and includes market data and other statistical information from third-party sources, including provincial gaming authorities. Although LACQ and the Company believes these third-party sources are reliable as of their respective dates, none of LACQ, the Company, or any of their respective affiliates has independently verified the accuracy or completeness of this information. Some data are also based 255 255 on the Company’s good faith estimates, which are derived from both internal sources and the third-party sources described above. None of LACQ, Gateway, any third-party source providing market data and statistical information, their respective affiliates, nor their respective directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy of such information (including 199 76 information from third-party sources). 0 0 233 117 0 47 76 138

0 221 46 0 86 49 Disclaimer (cont’d) 249 209 190 211 0 211 FORWARD-LOOKING INFORMATION 35 This Presentation contains forward-looking information within the meaning of applicable securities laws in Canada and the United States. Forward-looking statements may relate to Gateway’s, LACQ’s, or the combined 34 company‘s future financial outlook and anticipated events or results and may include information regarding our financial position, business strategy, growth strategies, growth objectives, budgets, operations, financial results, 34 taxes, dividend policy, regulatory developments, plans and objectives. All statements other than statements of historical fact are forward-looking statements. The use of any of the words anticipate , plan , contemplate , continue , estimate , expect , intend , propose , might , may , will , shall , project , should , could , would , believe , predict , forecast , pursue , potential and capable and similar expressions are intended to identify forward looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such 0 121 forward-looking statements. In addition, this Presentation may contain forward-looking statements attributed to third party industry sources, the accuracy of which has not been verified by LACQ or Gateway. No assurance can be 59 153 given that these expectations will prove to be correct and such forward-looking statements included in this Presentation should not be unduly relied upon. Statements containing forward-looking information are not historical facts but instead represent management's expectations, estimates and projections regarding future events or circumstances. Forward-looking information contained in this Presentation and other forward-looking information are based 113 0 on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. 59 196 92 214 Additionally, any estimates and projections contained herein have been prepared by the management of the Company and involve significant elements of subjective judgment and analysis, which may or may not be correct. This Presentation includes certain estimates, targets and projections that reflect Gateway management’s assumptions concerning anticipated future performance of Gateway as provided to LACQ on December 19, 2019. Such 173 0 estimates, targets and projections from are based on significant assumptions and subjective judgments concerning anticipated results, which are inherently subject to risks, variability and contingencies, many of which are beyond Gateway’s control. These assumptions and judgments may or may not prove to be correct and there can be no assurance that any projected results are attainable or will be realized. LACQ, Gateway, any third-party source 125 245 providing information and each of their respective representatives disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or 174 196 omitted from this Presentation (including information from third-party sources) and such liability is expressly disclaimed. 211 0 You are cautioned not to place undue reliance on any forward‐looking statements, which speak only as of the date of this Presentation. The forward-looking information contained in this Presentation represents our expectations as of the date of this Presentation or the date indicated, regardless of the time of delivery of the Presentation and is subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or 205 revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by law. 151 All of the forward-looking information contained in this Presentation is expressly qualified by the foregoing cautionary statements. 0 NON-IFRS MEASURES 126 This Presentation makes reference to certain financial and other measures commonly used by financial analysts in evaluating the financial performance of companies and by the Company’s management in evaluating its 153 operations, including companies in the gaming industry that are not presented in accordance with international financial reporting standards (“IFRS”). These measures are not recognized measures under IFRS and do not have a 192 standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial 146 information reported under IFRS. 146 We use non-IFRS measures including Adjusted EBITDA , Adjusted EBITDA Margin , Adjusted Property EBITDA , Adjusted Property EBITDA Margin , EBITDA , Free Cash Flow , Free Cash Flow Conversion , and Pro 146 Forma Adjusted EBITDA“ and these measures should not be considered as an alternative to net income (loss), earnings per share or any other performance measures derived in accordance with IFRS as measures of operating performance, operating cash flows or as measures of liquidity. For further details on these non-IFRS measures including relevant definitions and reconciliations, see the “Financial Overview” section of this Presentation. As of September 30, 2019, Starlight Casino Edmonton and Grand Villa Casino Edmonton are considered discontinued operations in Gateway’s consolidated financial statements. These properties are referred to in this 196 0 presentation as “Non-Core Properties.” Where indicated in this presentation, financial information of Gateway excludes the Non-Core Properties. 214 40 0 86 COMPARABLE COMPANIES Certain information presented herein compares the Company to other issuers and such data sets are considered to be comparables . The information is a summary of certain relevant operational attributes of certain gaming 255 255 issuers and has been included to provide interested parties an overview of the performance of what are expected to be comparable issuers. These issuers are in the same industry, provide similar services and operate in similar 199 76 regulatory environments and each should be considered an appropriate basis for comparison to the Company. The information regarding the comparables was obtained from public sources, has not been verified by LACQ, the 0 0 Company, or any of their respective affiliates and if such information contains a misrepresentation, interested parties do not have a remedy under securities legislation in any province or territory of Canada. There are risks associated with comparables, including the integrity of the underlying information and the ability to isolate specific variables which may impact one issuer and not another. There are risks associated with making investment decisions based on comparables including whether data presented provides a complete comparison between issuers. Interested parties are cautioned that past performance is not indicative of future performance and the 233 117 performance of the Company may be materially different from the comparable issuers. Accordingly, an investment decision should not be made in reliance on the comparables. 0 47 76 138 0 221 46 0 86 49 Disclaimer (cont’d) 249 209 190 211 0 211 FORWARD-LOOKING INFORMATION 35 This Presentation contains forward-looking information within the meaning of applicable securities laws in Canada and the United States. Forward-looking statements may relate to Gateway’s, LACQ’s, or the combined 34 company‘s future financial outlook and anticipated events or results and may include information regarding our financial position, business strategy, growth strategies, growth objectives, budgets, operations, financial results, 34 taxes, dividend policy, regulatory developments, plans and objectives. All statements other than statements of historical fact are forward-looking statements. The use of any of the words anticipate , plan , contemplate , continue , estimate , expect , intend , propose , might , may , will , shall , project , should , could , would , believe , predict , forecast , pursue , potential and capable and similar expressions are intended to identify forward looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such 0 121 forward-looking statements. In addition, this Presentation may contain forward-looking statements attributed to third party industry sources, the accuracy of which has not been verified by LACQ or Gateway. No assurance can be 59 153 given that these expectations will prove to be correct and such forward-looking statements included in this Presentation should not be unduly relied upon. Statements containing forward-looking information are not historical facts but instead represent management's expectations, estimates and projections regarding future events or circumstances. Forward-looking information contained in this Presentation and other forward-looking information are based 113 0 on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. 59 196 92 214 Additionally, any estimates and projections contained herein have been prepared by the management of the Company and involve significant elements of subjective judgment and analysis, which may or may not be correct. This Presentation includes certain estimates, targets and projections that reflect Gateway management’s assumptions concerning anticipated future performance of Gateway as provided to LACQ on December 19, 2019. Such 173 0 estimates, targets and projections from are based on significant assumptions and subjective judgments concerning anticipated results, which are inherently subject to risks, variability and contingencies, many of which are beyond Gateway’s control. These assumptions and judgments may or may not prove to be correct and there can be no assurance that any projected results are attainable or will be realized. LACQ, Gateway, any third-party source 125 245 providing information and each of their respective representatives disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or 174 196 omitted from this Presentation (including information from third-party sources) and such liability is expressly disclaimed. 211 0 You are cautioned not to place undue reliance on any forward‐looking statements, which speak only as of the date of this Presentation. The forward-looking information contained in this Presentation represents our expectations as of the date of this Presentation or the date indicated, regardless of the time of delivery of the Presentation and is subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or 205 revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by law. 151 All of the forward-looking information contained in this Presentation is expressly qualified by the foregoing cautionary statements. 0 NON-IFRS MEASURES 126 This Presentation makes reference to certain financial and other measures commonly used by financial analysts in evaluating the financial performance of companies and by the Company’s management in evaluating its 153 operations, including companies in the gaming industry that are not presented in accordance with international financial reporting standards (“IFRS”). These measures are not recognized measures under IFRS and do not have a 192 standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial 146 information reported under IFRS. 146 We use non-IFRS measures including Adjusted EBITDA , Adjusted EBITDA Margin , Adjusted Property EBITDA , Adjusted Property EBITDA Margin , EBITDA , Free Cash Flow , Free Cash Flow Conversion , and Pro 146 Forma Adjusted EBITDA“ and these measures should not be considered as an alternative to net income (loss), earnings per share or any other performance measures derived in accordance with IFRS as measures of operating performance, operating cash flows or as measures of liquidity. For further details on these non-IFRS measures including relevant definitions and reconciliations, see the “Financial Overview” section of this Presentation. As of September 30, 2019, Starlight Casino Edmonton and Grand Villa Casino Edmonton are considered discontinued operations in Gateway’s consolidated financial statements. These properties are referred to in this 196 0 presentation as “Non-Core Properties.” Where indicated in this presentation, financial information of Gateway excludes the Non-Core Properties. 214 40 0 86 COMPARABLE COMPANIES Certain information presented herein compares the Company to other issuers and such data sets are considered to be comparables . The information is a summary of certain relevant operational attributes of certain gaming 255 255 issuers and has been included to provide interested parties an overview of the performance of what are expected to be comparable issuers. These issuers are in the same industry, provide similar services and operate in similar 199 76 regulatory environments and each should be considered an appropriate basis for comparison to the Company. The information regarding the comparables was obtained from public sources, has not been verified by LACQ, the 0 0 Company, or any of their respective affiliates and if such information contains a misrepresentation, interested parties do not have a remedy under securities legislation in any province or territory of Canada. There are risks associated with comparables, including the integrity of the underlying information and the ability to isolate specific variables which may impact one issuer and not another. There are risks associated with making investment decisions based on comparables including whether data presented provides a complete comparison between issuers. Interested parties are cautioned that past performance is not indicative of future performance and the 233 117 performance of the Company may be materially different from the comparable issuers. Accordingly, an investment decision should not be made in reliance on the comparables. 0 47 76 138

0 221 46 0 86 49 249 209 190 211 0 211 35 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 174 196 Gateway Casinos & Entertainment 211 0 205 A Leading Operator of Integrated Gaming and 151 0 Entertainment Destinations Across Canada 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138 0 221 46 0 86 49 249 209 190 211 0 211 35 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 174 196 Gateway Casinos & Entertainment 211 0 205 A Leading Operator of Integrated Gaming and 151 0 Entertainment Destinations Across Canada 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138

0 221 46 0 86 49 Section 1 249 209 190 211 0 211 35 34 34 0 121 59 153 Transaction 113 0 Overview 59 196 92 214 173 0 125 245 174 196 211 0 205 151 0 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138 0 221 46 0 86 49 Section 1 249 209 190 211 0 211 35 34 34 0 121 59 153 Transaction 113 0 Overview 59 196 92 214 173 0 125 245 174 196 211 0 205 151 0 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138

0 221 46 0 86 49 (1) Transaction Summary 249 209 190 211 0 211 • Leisure Acquisition Corp. (“LACQ”) to merge with a wholly-owned subsidiary of GTWY Holdings Limited (“GTWY”), the 35 parent holding company and sole shareholder of Gateway Casinos, with LACQ shareholders / warrant holders to receive 34 GTWY common shares / warrants upon the merger Transaction Structure 34 • GTWY common shares expected to be listed on the NYSE upon consummation of the transaction, with GTWY qualifying as a foreign private issuer 0 121 • US$1.1Bn (C$1.5Bn) pro forma enterprise valuation 59 153 Valuation 113 0 (2) • 7.5x 2020 Projected Adjusted EBITDA 59 196 • US$30MM equity commitment from HG Vora Capital Management LLC (“HG Vora”); including existing invested capital, HG 92 214 (3) Vora’s total capital commitment to the Company is in excess of US$100MM 173 0 (4) Funding Sources • Up to US$189MM LACQ Trust rollover proceeds 125 245 • Gateway shareholders rollover 174 196 211 0 • Existing Gateway shareholders eligible to receive an earn-out of 1.898 million and 2.846 million shares that vest upon GTWY stock trading at greater than $12.50 and $15.00 per share over a 2 and 3 year period, respectively 205 • 18.975 million newly-issued warrants (equal tranches struck at US$11.50, US$12.50 and US$15.00 per share) issued to 151 Contingent existing Gateway shareholders, to align incentives. Existing private warrants held by LACQ insiders and HG Vora (and HG Vora 0 Consideration private warrants from equity commitment) to be amended to be equal tranches struck at US$11.50, US$12.50 and US$15.00 126 • 1.281 million options issued to certain members of management in the same proportion and equivalent term and conditions as 153 the earn-out payment and the warrants being issued to existing shareholders of Gateway 192 • LACQ and GTWY shareholder approval, gaming regulatory approvals and contractual approvals from Crown agencies Required Approvals 146 • Registration statement and approval for listing on NYSE 146 146 • Marc Falcone expected to become President and CEO of Gateway shortly following completion of the transaction • Lorne Weil, Daniel Silvers, Marc Falcone, Lyle Hall, Olga Ilich and Dr. Michael Percy are expected to join Gateway’s Board Management and and Gabriel de Alba will continue to serve as Gateway’s Executive Chairman Independent Board 196 0 • Two additional independent directors will be appointed at or following the completion of the transaction such that Gateway’s 214 40 Board will be comprised of up to 9 members 0 86 • The two Edmonton properties (Starlight Casino Edmonton and Grand Villa Casino Edmonton) are considered discontinued 255 255 operations and are contemplated as being carved-out from the transaction (the “Non-Core Properties”) Other 199 76 • All numbers presented in this presentation exclude the Non-Core Properties unless otherwise noted 0 0 Notes: 1. Figures converted from USD to CAD at an exchange ratio of 1.3122 as of 12/26/19 as filed in the 8-K 2. Based on 2020P (pre-IFRS 16) Adjusted EBITDA of C$195MM as provided by Gateway management, excluding the impact of the Non-Core Properties. The 7.5x transaction multiple is shown before any LACQ and/or shared fees and expenses. To the extent 233 117 Gateway’s shareholders pay LACQ’s fees and expenses, shares issued to the existing Gateway shareholders shall increase on a pro rata basis by the amount of LACQ’s fees paid by Gateway’s shareholders 3. Includes existing investment in GTWY Holdings loan 0 47 4. US$11.2MM redeemed on 11/26/2019; LACQ trust account includes US$10MM of proceeds from HG Vora 76 138 2 0 221 46 0 86 49 (1) Transaction Summary 249 209 190 211 0 211 • Leisure Acquisition Corp. (“LACQ”) to merge with a wholly-owned subsidiary of GTWY Holdings Limited (“GTWY”), the 35 parent holding company and sole shareholder of Gateway Casinos, with LACQ shareholders / warrant holders to receive 34 GTWY common shares / warrants upon the merger Transaction Structure 34 • GTWY common shares expected to be listed on the NYSE upon consummation of the transaction, with GTWY qualifying as a foreign private issuer 0 121 • US$1.1Bn (C$1.5Bn) pro forma enterprise valuation 59 153 Valuation 113 0 (2) • 7.5x 2020 Projected Adjusted EBITDA 59 196 • US$30MM equity commitment from HG Vora Capital Management LLC (“HG Vora”); including existing invested capital, HG 92 214 (3) Vora’s total capital commitment to the Company is in excess of US$100MM 173 0 (4) Funding Sources • Up to US$189MM LACQ Trust rollover proceeds 125 245 • Gateway shareholders rollover 174 196 211 0 • Existing Gateway shareholders eligible to receive an earn-out of 1.898 million and 2.846 million shares that vest upon GTWY stock trading at greater than $12.50 and $15.00 per share over a 2 and 3 year period, respectively 205 • 18.975 million newly-issued warrants (equal tranches struck at US$11.50, US$12.50 and US$15.00 per share) issued to 151 Contingent existing Gateway shareholders, to align incentives. Existing private warrants held by LACQ insiders and HG Vora (and HG Vora 0 Consideration private warrants from equity commitment) to be amended to be equal tranches struck at US$11.50, US$12.50 and US$15.00 126 • 1.281 million options issued to certain members of management in the same proportion and equivalent term and conditions as 153 the earn-out payment and the warrants being issued to existing shareholders of Gateway 192 • LACQ and GTWY shareholder approval, gaming regulatory approvals and contractual approvals from Crown agencies Required Approvals 146 • Registration statement and approval for listing on NYSE 146 146 • Marc Falcone expected to become President and CEO of Gateway shortly following completion of the transaction • Lorne Weil, Daniel Silvers, Marc Falcone, Lyle Hall, Olga Ilich and Dr. Michael Percy are expected to join Gateway’s Board Management and and Gabriel de Alba will continue to serve as Gateway’s Executive Chairman Independent Board 196 0 • Two additional independent directors will be appointed at or following the completion of the transaction such that Gateway’s 214 40 Board will be comprised of up to 9 members 0 86 • The two Edmonton properties (Starlight Casino Edmonton and Grand Villa Casino Edmonton) are considered discontinued 255 255 operations and are contemplated as being carved-out from the transaction (the “Non-Core Properties”) Other 199 76 • All numbers presented in this presentation exclude the Non-Core Properties unless otherwise noted 0 0 Notes: 1. Figures converted from USD to CAD at an exchange ratio of 1.3122 as of 12/26/19 as filed in the 8-K 2. Based on 2020P (pre-IFRS 16) Adjusted EBITDA of C$195MM as provided by Gateway management, excluding the impact of the Non-Core Properties. The 7.5x transaction multiple is shown before any LACQ and/or shared fees and expenses. To the extent 233 117 Gateway’s shareholders pay LACQ’s fees and expenses, shares issued to the existing Gateway shareholders shall increase on a pro rata basis by the amount of LACQ’s fees paid by Gateway’s shareholders 3. Includes existing investment in GTWY Holdings loan 0 47 4. US$11.2MM redeemed on 11/26/2019; LACQ trust account includes US$10MM of proceeds from HG Vora 76 138 2

0 221 46 0 86 49 Transaction Summary (cont’d) 249 209 190 211 0 211 35 34 (1) (2) (1) (2) (3) Sources and Uses Pro Forma Capitalization 34 ($MM) ($MM, except share price) C$ US$ 0 121 Sources of Funds C$ US$ 59 153 (3) 248 189 Sellers' Rollover Equity 237 181 SPAC Trust Proceeds 113 0 HG Vora Equity Commitment 39 30 (÷) Issue Price of LACQ Shares $13.12 $10.00 59 196 Total Sources 287 219 Estimated Sellers Rollover Shares (MM) 18.055 18.055 92 214 (+) LACQ Public Shareholders 17.876 17.876 173 0 Uses of Funds C$ US$ (+) LACQ Management and Board Shares 1.538 1.538 (4) 56 42 Gross Cash to Gateway Shareholders 125 245 (+) HG Vora 6.463 6.463 174 196 OpCo Debt Paydown 14 11 211 0 (5) 201 154 Fully Diluted Shares Outstanding (MM) 43.931 43.931 Cash to Paydown HoldCo Term Loan (6) 16 12 Illustrative Transaction Fees (x) Issue Price of LACQ Shares $13.12 $10.00 205 Total Uses 287 219 151 Implied Total Equity Value $576 $439 0 (+) Rollover Debt 939 716 (7) 126 Pro Forma Ownership (-) Cash (53) (40) 153 Implied Enterprise Value $1,463 $1,115 (MM) 192 Common Equity 12/31/2019 Adj. PF % Catalyst Shares -- 13.282 13.282 30.2% 146 Adjusted EBITDA Implied 146 Other Current Gateway S/H -- 4.772 4.772 10.9% Projections Multiple 146 LACQ Public Shareholders 17.876 -- 17.876 40.7% C$ US$ (8) 2.538 (1.000) 1.538 3.5% (9) LACQ Management and Board 2020P Adjusted EBITDA $195 $149 7.5x HG Vora 6.463 -- 6.463 14.7% (9) 196 $215 $164 6.8x 0 2021P Adjusted EBITDA Total Ownership Shares 26.876 17.055 43.931 100.0% 214 40 (10) 5.2x Total Debt / 2020P Adjusted EBITDA 0 86 (10) 4.8x Total Debt / 2021P Adjusted EBITDA Notes: 1. Assumes no SPAC redemptions beyond US$11.2MM redeemed on 11/26/2019; excludes shared expenses 255 255 2. Figures converted from USD to CAD exchange ratio of 1.3122 as of 12/26/19, day prior to transaction announcement 199 76 3. Assumes full roll of HG Vora US$10MM Public Float 4. Represents gross cash proceeds to existing Gateway shareholders prior to the payment of any transaction fees or management incentive payments; to the extent Gateway’s shareholders pay LACQ’s fees, shares issued to Gateway shareholders will be 0 0 increased on a pro rata basis by the amount of LACQ’s fees paid by Gateway’s shareholders 5. Balance as of 12/31/2019 as projected by Gateway Management 6. Transaction fees shown net of illustrative accrued interest available in LACQ Trust 7. Pro Forma Ownership represents ownership at close before the exercise of warrants and vesting of earn-outs and options 233 117 8. Catalyst and other current Gateway shareholders to be allocated 1MM founder shares pro rata from members of LACQ Management 9. Adjusted EBITDA projections as provided by Gateway management (pre-IFRS 16) excluding Adjusted EBITDA from the Non-Core Properties 0 47 10. Leverage stats include C$82MM letters of credit; based on 2020P and 2021P Adjusted EBITDA of C$195MM and C$215MM, respectively 76 138 3 0 221 46 0 86 49 Transaction Summary (cont’d) 249 209 190 211 0 211 35 34 (1) (2) (1) (2) (3) Sources and Uses Pro Forma Capitalization 34 ($MM) ($MM, except share price) C$ US$ 0 121 Sources of Funds C$ US$ 59 153 (3) 248 189 Sellers' Rollover Equity 237 181 SPAC Trust Proceeds 113 0 HG Vora Equity Commitment 39 30 (÷) Issue Price of LACQ Shares $13.12 $10.00 59 196 Total Sources 287 219 Estimated Sellers Rollover Shares (MM) 18.055 18.055 92 214 (+) LACQ Public Shareholders 17.876 17.876 173 0 Uses of Funds C$ US$ (+) LACQ Management and Board Shares 1.538 1.538 (4) 56 42 Gross Cash to Gateway Shareholders 125 245 (+) HG Vora 6.463 6.463 174 196 OpCo Debt Paydown 14 11 211 0 (5) 201 154 Fully Diluted Shares Outstanding (MM) 43.931 43.931 Cash to Paydown HoldCo Term Loan (6) 16 12 Illustrative Transaction Fees (x) Issue Price of LACQ Shares $13.12 $10.00 205 Total Uses 287 219 151 Implied Total Equity Value $576 $439 0 (+) Rollover Debt 939 716 (7) 126 Pro Forma Ownership (-) Cash (53) (40) 153 Implied Enterprise Value $1,463 $1,115 (MM) 192 Common Equity 12/31/2019 Adj. PF % Catalyst Shares -- 13.282 13.282 30.2% 146 Adjusted EBITDA Implied 146 Other Current Gateway S/H -- 4.772 4.772 10.9% Projections Multiple 146 LACQ Public Shareholders 17.876 -- 17.876 40.7% C$ US$ (8) 2.538 (1.000) 1.538 3.5% (9) LACQ Management and Board 2020P Adjusted EBITDA $195 $149 7.5x HG Vora 6.463 -- 6.463 14.7% (9) 196 $215 $164 6.8x 0 2021P Adjusted EBITDA Total Ownership Shares 26.876 17.055 43.931 100.0% 214 40 (10) 5.2x Total Debt / 2020P Adjusted EBITDA 0 86 (10) 4.8x Total Debt / 2021P Adjusted EBITDA Notes: 1. Assumes no SPAC redemptions beyond US$11.2MM redeemed on 11/26/2019; excludes shared expenses 255 255 2. Figures converted from USD to CAD exchange ratio of 1.3122 as of 12/26/19, day prior to transaction announcement 199 76 3. Assumes full roll of HG Vora US$10MM Public Float 4. Represents gross cash proceeds to existing Gateway shareholders prior to the payment of any transaction fees or management incentive payments; to the extent Gateway’s shareholders pay LACQ’s fees, shares issued to Gateway shareholders will be 0 0 increased on a pro rata basis by the amount of LACQ’s fees paid by Gateway’s shareholders 5. Balance as of 12/31/2019 as projected by Gateway Management 6. Transaction fees shown net of illustrative accrued interest available in LACQ Trust 7. Pro Forma Ownership represents ownership at close before the exercise of warrants and vesting of earn-outs and options 233 117 8. Catalyst and other current Gateway shareholders to be allocated 1MM founder shares pro rata from members of LACQ Management 9. Adjusted EBITDA projections as provided by Gateway management (pre-IFRS 16) excluding Adjusted EBITDA from the Non-Core Properties 0 47 10. Leverage stats include C$82MM letters of credit; based on 2020P and 2021P Adjusted EBITDA of C$195MM and C$215MM, respectively 76 138 3

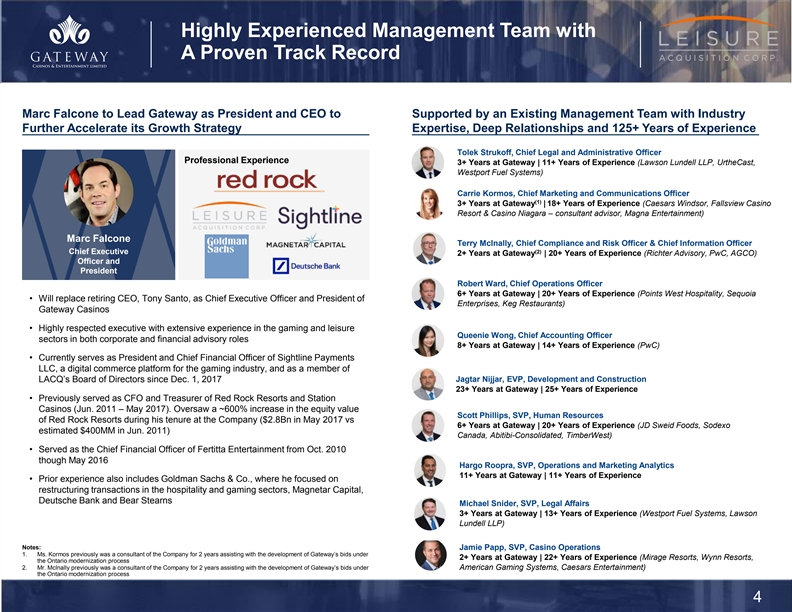

0 221 46 0 86 49 Highly Experienced Management Team with 249 209 A Proven Track Record 190 211 0 211 35 34 Marc Falcone to Lead Gateway as President and CEO to Supported by an Existing Management Team with Industry 34 Further Accelerate its Growth Strategy Expertise, Deep Relationships and 125+ Years of Experience Tolek Strukoff, Chief Legal and Administrative Officer 0 121 Professional Experience 3+ Years at Gateway | 11+ Years of Experience (Lawson Lundell LLP, UrtheCast, 59 153 Westport Fuel Systems) 113 0 Carrie Kormos, Chief Marketing and Communications Officer (1) 3+ Years at Gateway | 18+ Years of Experience (Caesars Windsor, Fallsview Casino 59 196 Resort & Casino Niagara – consultant advisor, Magna Entertainment) 92 214 173 0 Marc Falcone Terry McInally, Chief Compliance and Risk Officer & Chief Information Officer Chief Executive (2) 125 245 2+ Years at Gateway | 20+ Years of Experience (Richter Advisory, PwC, AGCO) Officer and 174 196 President 211 0 Robert Ward, Chief Operations Officer 6+ Years at Gateway | 20+ Years of Experience (Points West Hospitality, Sequoia • Will replace retiring CEO, Tony Santo, as Chief Executive Officer and President of Enterprises, Keg Restaurants) 205 Gateway Casinos 151 0 • Highly respected executive with extensive experience in the gaming and leisure Queenie Wong, Chief Accounting Officer sectors in both corporate and financial advisory roles 8+ Years at Gateway | 14+ Years of Experience (PwC) 126 • Currently serves as President and Chief Financial Officer of Sightline Payments 153 LLC, a digital commerce platform for the gaming industry, and as a member of 192 LACQ’s Board of Directors since Dec. 1, 2017 Jagtar Nijjar, EVP, Development and Construction 23+ Years at Gateway | 25+ Years of Experience • Previously served as CFO and Treasurer of Red Rock Resorts and Station 146 Casinos (Jun. 2011 – May 2017). Oversaw a ~600% increase in the equity value 146 Scott Phillips, SVP, Human Resources of Red Rock Resorts during his tenure at the Company ($2.8Bn in May 2017 vs 146 6+ Years at Gateway | 20+ Years of Experience (JD Sweid Foods, Sodexo estimated $400MM in Jun. 2011) Canada, Abitibi-Consolidated, TimberWest) • Served as the Chief Financial Officer of Fertitta Entertainment from Oct. 2010 though May 2016 196 0 Hargo Roopra, SVP, Operations and Marketing Analytics 214 40 11+ Years at Gateway | 11+ Years of Experience • Prior experience also includes Goldman Sachs & Co., where he focused on 0 86 restructuring transactions in the hospitality and gaming sectors, Magnetar Capital, Deutsche Bank and Bear Stearns Michael Snider, SVP, Legal Affairs 255 255 3+ Years at Gateway | 13+ Years of Experience (Westport Fuel Systems, Lawson 199 76 Lundell LLP) 0 0 Notes: Jamie Papp, SVP, Casino Operations 1. Ms. Kormos previously was a consultant of the Company for 2 years assisting with the development of Gateway’s bids under 2+ Years at Gateway | 22+ Years of Experience (Mirage Resorts, Wynn Resorts, 233 117 the Ontario modernization process 2. Mr. McInally previously was a consultant of the Company for 2 years assisting with the development of Gateway’s bids under American Gaming Systems, Caesars Entertainment) 0 47 the Ontario modernization process 76 138 4 0 221 46 0 86 49 Highly Experienced Management Team with 249 209 A Proven Track Record 190 211 0 211 35 34 Marc Falcone to Lead Gateway as President and CEO to Supported by an Existing Management Team with Industry 34 Further Accelerate its Growth Strategy Expertise, Deep Relationships and 125+ Years of Experience Tolek Strukoff, Chief Legal and Administrative Officer 0 121 Professional Experience 3+ Years at Gateway | 11+ Years of Experience (Lawson Lundell LLP, UrtheCast, 59 153 Westport Fuel Systems) 113 0 Carrie Kormos, Chief Marketing and Communications Officer (1) 3+ Years at Gateway | 18+ Years of Experience (Caesars Windsor, Fallsview Casino 59 196 Resort & Casino Niagara – consultant advisor, Magna Entertainment) 92 214 173 0 Marc Falcone Terry McInally, Chief Compliance and Risk Officer & Chief Information Officer Chief Executive (2) 125 245 2+ Years at Gateway | 20+ Years of Experience (Richter Advisory, PwC, AGCO) Officer and 174 196 President 211 0 Robert Ward, Chief Operations Officer 6+ Years at Gateway | 20+ Years of Experience (Points West Hospitality, Sequoia • Will replace retiring CEO, Tony Santo, as Chief Executive Officer and President of Enterprises, Keg Restaurants) 205 Gateway Casinos 151 0 • Highly respected executive with extensive experience in the gaming and leisure Queenie Wong, Chief Accounting Officer sectors in both corporate and financial advisory roles 8+ Years at Gateway | 14+ Years of Experience (PwC) 126 • Currently serves as President and Chief Financial Officer of Sightline Payments 153 LLC, a digital commerce platform for the gaming industry, and as a member of 192 LACQ’s Board of Directors since Dec. 1, 2017 Jagtar Nijjar, EVP, Development and Construction 23+ Years at Gateway | 25+ Years of Experience • Previously served as CFO and Treasurer of Red Rock Resorts and Station 146 Casinos (Jun. 2011 – May 2017). Oversaw a ~600% increase in the equity value 146 Scott Phillips, SVP, Human Resources of Red Rock Resorts during his tenure at the Company ($2.8Bn in May 2017 vs 146 6+ Years at Gateway | 20+ Years of Experience (JD Sweid Foods, Sodexo estimated $400MM in Jun. 2011) Canada, Abitibi-Consolidated, TimberWest) • Served as the Chief Financial Officer of Fertitta Entertainment from Oct. 2010 though May 2016 196 0 Hargo Roopra, SVP, Operations and Marketing Analytics 214 40 11+ Years at Gateway | 11+ Years of Experience • Prior experience also includes Goldman Sachs & Co., where he focused on 0 86 restructuring transactions in the hospitality and gaming sectors, Magnetar Capital, Deutsche Bank and Bear Stearns Michael Snider, SVP, Legal Affairs 255 255 3+ Years at Gateway | 13+ Years of Experience (Westport Fuel Systems, Lawson 199 76 Lundell LLP) 0 0 Notes: Jamie Papp, SVP, Casino Operations 1. Ms. Kormos previously was a consultant of the Company for 2 years assisting with the development of Gateway’s bids under 2+ Years at Gateway | 22+ Years of Experience (Mirage Resorts, Wynn Resorts, 233 117 the Ontario modernization process 2. Mr. McInally previously was a consultant of the Company for 2 years assisting with the development of Gateway’s bids under American Gaming Systems, Caesars Entertainment) 0 47 the Ontario modernization process 76 138 4

0 221 46 0 86 49 Investment Highlights 249 209 190 211 0 211 35 Gateway: Platform Positioned for Strong EBITDA Growth and FCF Generation 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 174 196 211 0 1 2 3 4 5 6 205 151 Attractive and Unique and Differentiated Operates in Strong Track Proven Branding 0 Diverse Property Attractive Business Model Highly Populated Record of Strategy Focused Portfolio with a Regulatory Expected to Drive Markets Successful on Proprietary 126 Geographically Environment Strong Free Cash that are Relatively Capital Allocation Offerings 153 Broad and Flow Conversion Underpenetrated Tailored to Local 192 Economically and Historically Market Diversified Resilient 146 Footprint 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138 5 0 221 46 0 86 49 Investment Highlights 249 209 190 211 0 211 35 Gateway: Platform Positioned for Strong EBITDA Growth and FCF Generation 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 174 196 211 0 1 2 3 4 5 6 205 151 Attractive and Unique and Differentiated Operates in Strong Track Proven Branding 0 Diverse Property Attractive Business Model Highly Populated Record of Strategy Focused Portfolio with a Regulatory Expected to Drive Markets Successful on Proprietary 126 Geographically Environment Strong Free Cash that are Relatively Capital Allocation Offerings 153 Broad and Flow Conversion Underpenetrated Tailored to Local 192 Economically and Historically Market Diversified Resilient 146 Footprint 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138 5

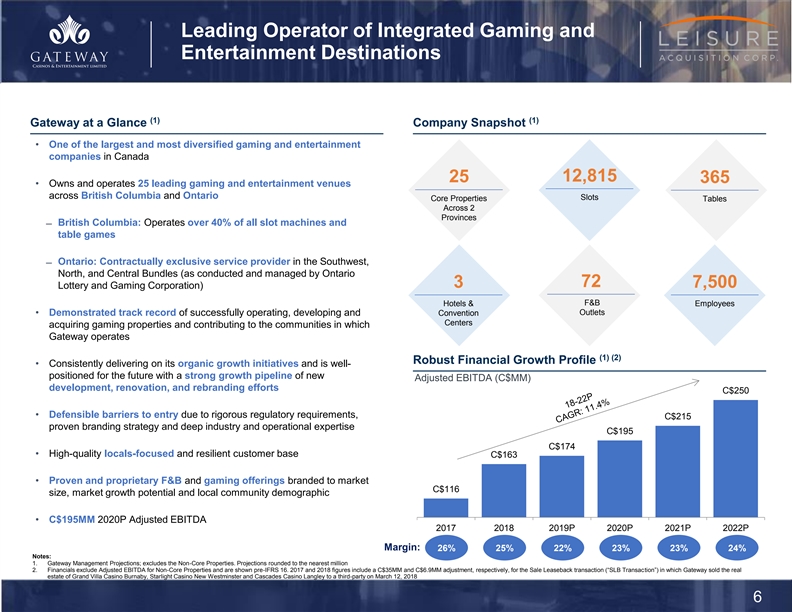

0 221 46 0 86 49 Leading Operator of Integrated Gaming and 249 209 Entertainment Destinations 190 211 0 211 35 34 (1) (1) Gateway at a Glance Company Snapshot 34 • One of the largest and most diversified gaming and entertainment 0 121 companies in Canada 59 153 25 12,815 365 113 0 • Owns and operates 25 leading gaming and entertainment venues across British Columbia and Ontario Slots Core Properties Tables 59 196 Across 2 92 214 Provinces ̶ British Columbia: Operates over 40% of all slot machines and 173 0 table games 125 245 ̶ Ontario: Contractually exclusive service provider in the Southwest, 174 196 North, and Central Bundles (as conducted and managed by Ontario 211 0 72 3 7,500 Lottery and Gaming Corporation) Hotels & F&B Employees 205 Outlets • Demonstrated track record of successfully operating, developing and Convention 151 Centers acquiring gaming properties and contributing to the communities in which 0 Gateway operates 126 (1) (2) Robust Financial Growth Profile 153 • Consistently delivering on its organic growth initiatives and is well- 192 positioned for the future with a strong growth pipeline of new Adjusted EBITDA (C$MM) development, renovation, and rebranding efforts C$250 146 146 • Defensible barriers to entry due to rigorous regulatory requirements, C$215 146 proven branding strategy and deep industry and operational expertise C$195 C$174 • High-quality locals-focused and resilient customer base C$163 196 0 214 40 • Proven and proprietary F&B and gaming offerings branded to market 0 86 C$116 size, market growth potential and local community demographic 255 255 • C$195MM 2020P Adjusted EBITDA 199 76 2017 2018 2019P 2020P 2021P 2022P 0 0 Margin: 26% 25% 22% 23% 23% 24% Notes: 233 117 1. Gateway Management Projections; excludes the Non-Core Properties. Projections rounded to the nearest million 2. Financials exclude Adjusted EBITDA for Non-Core Properties and are shown pre-IFRS 16. 2017 and 2018 figures include a C$35MM and C$6.9MM adjustment, respectively, for the Sale Leaseback transaction (“SLB Transaction”) in which Gateway sold the real 0 47 estate of Grand Villa Casino Burnaby, Starlight Casino New Westminster and Cascades Casino Langley to a third-party on March 12, 2018 76 138 6 0 221 46 0 86 49 Leading Operator of Integrated Gaming and 249 209 Entertainment Destinations 190 211 0 211 35 34 (1) (1) Gateway at a Glance Company Snapshot 34 • One of the largest and most diversified gaming and entertainment 0 121 companies in Canada 59 153 25 12,815 365 113 0 • Owns and operates 25 leading gaming and entertainment venues across British Columbia and Ontario Slots Core Properties Tables 59 196 Across 2 92 214 Provinces ̶ British Columbia: Operates over 40% of all slot machines and 173 0 table games 125 245 ̶ Ontario: Contractually exclusive service provider in the Southwest, 174 196 North, and Central Bundles (as conducted and managed by Ontario 211 0 72 3 7,500 Lottery and Gaming Corporation) Hotels & F&B Employees 205 Outlets • Demonstrated track record of successfully operating, developing and Convention 151 Centers acquiring gaming properties and contributing to the communities in which 0 Gateway operates 126 (1) (2) Robust Financial Growth Profile 153 • Consistently delivering on its organic growth initiatives and is well- 192 positioned for the future with a strong growth pipeline of new Adjusted EBITDA (C$MM) development, renovation, and rebranding efforts C$250 146 146 • Defensible barriers to entry due to rigorous regulatory requirements, C$215 146 proven branding strategy and deep industry and operational expertise C$195 C$174 • High-quality locals-focused and resilient customer base C$163 196 0 214 40 • Proven and proprietary F&B and gaming offerings branded to market 0 86 C$116 size, market growth potential and local community demographic 255 255 • C$195MM 2020P Adjusted EBITDA 199 76 2017 2018 2019P 2020P 2021P 2022P 0 0 Margin: 26% 25% 22% 23% 23% 24% Notes: 233 117 1. Gateway Management Projections; excludes the Non-Core Properties. Projections rounded to the nearest million 2. Financials exclude Adjusted EBITDA for Non-Core Properties and are shown pre-IFRS 16. 2017 and 2018 figures include a C$35MM and C$6.9MM adjustment, respectively, for the Sale Leaseback transaction (“SLB Transaction”) in which Gateway sold the real 0 47 estate of Grand Villa Casino Burnaby, Starlight Casino New Westminster and Cascades Casino Langley to a third-party on March 12, 2018 76 138 6

0 221 46 0 86 49 Illustrative Trading Comparables 249 209 190 211 0 211 35 Gateway Offers a Compelling Value Proposition when Compared with Gaming Peers 34 34 2020P Enterprise Value (EV) / Adjusted EBITDA Multiples 0 121 16.0x 59 153 113 0 14.2x 59 196 92 214 12.5x 173 0 125 245 174 196 9.7x 211 0 9.0x 8.9x 8.7x 8.4x 205 7.5x 151 0 126 153 192 146 146 146 (2) (4) (5) (1) (3) 196 0 214 40 0 86 2021P EV / Adjusted 255 255 6.8x 8.8x 14.0x 11.6x 11.6x 8.8x 8.0x 8.8x 8.1x EBITDA 199 76 Multiples: Source: Capital IQ and Wall Street research as of 2/10/2020 0 0 Notes: 1. Gateway EV / Adjusted EBITDA multiple based on enterprise value implied by US$10.00 per share cost basis; 2020 (pre-IFRS 16) Adjusted EBITDA of C$195MM based on Gateway management projections excluding Non-Core Properties 2. Pro Forma for Great Canadian’s acquisition of Clairvest’s interest in the West GTA and GTA Bundles. Includes an estimated C$510MM and C$706MM adjustment for future estimated attributable capex spend at the West GTA and GTA Bundles in 2020 and 2021, respectively 233 117 3. Pro forma for the expiration of the Native American Management Fee 4. Includes $250MM of synergies 0 47 5. Includes $500MM of synergies 76 138 7 0 221 46 0 86 49 Illustrative Trading Comparables 249 209 190 211 0 211 35 Gateway Offers a Compelling Value Proposition when Compared with Gaming Peers 34 34 2020P Enterprise Value (EV) / Adjusted EBITDA Multiples 0 121 16.0x 59 153 113 0 14.2x 59 196 92 214 12.5x 173 0 125 245 174 196 9.7x 211 0 9.0x 8.9x 8.7x 8.4x 205 7.5x 151 0 126 153 192 146 146 146 (2) (4) (5) (1) (3) 196 0 214 40 0 86 2021P EV / Adjusted 255 255 6.8x 8.8x 14.0x 11.6x 11.6x 8.8x 8.0x 8.8x 8.1x EBITDA 199 76 Multiples: Source: Capital IQ and Wall Street research as of 2/10/2020 0 0 Notes: 1. Gateway EV / Adjusted EBITDA multiple based on enterprise value implied by US$10.00 per share cost basis; 2020 (pre-IFRS 16) Adjusted EBITDA of C$195MM based on Gateway management projections excluding Non-Core Properties 2. Pro Forma for Great Canadian’s acquisition of Clairvest’s interest in the West GTA and GTA Bundles. Includes an estimated C$510MM and C$706MM adjustment for future estimated attributable capex spend at the West GTA and GTA Bundles in 2020 and 2021, respectively 233 117 3. Pro forma for the expiration of the Native American Management Fee 4. Includes $250MM of synergies 0 47 5. Includes $500MM of synergies 76 138 7

0 221 46 0 86 49 Key Metrics Versus Selected “Locals” Comps 249 209 190 211 0 211 35 34 34 Superior Operating Metrics… …At A Meaningful Valuation Discount 0 121 59 153 12.5x 113 0 11.6x Strong 11.2% Adjusted 59 196 Highly 9.0x 8.8x 92 214 EBITDA Growth Attractive EV / 173 0 7.5x Profile Adjusted 6.8x EBITDA (19P-21P 125 245 2.5% 2.2% Multiple 174 196 Expected 211 0 CAGR) (1) 2020P 2021P 2020P 2021P 2020P 2021P 205 151 0 EV / 2020P Adjusted EV / 2021P Adjusted EBITDA EBITDA 126 153 192 90.8% 146 81.7% Superior Free Industry- 76.2% 12.1% 146 Cash Flow Leading FCF 146 8.5% Conversion Yield 6.5% (2) (3) (2020P) (2020P) 196 0 214 40 0 86 (1) (1) 255 255 199 76 0 0 Source: All Projections for Red Rock and Boyd from Capital IQ and Wall Street research as of 2/10/2020 Notes: 1. Pro forma for the expiration of the Native American Management Fee 233 117 2. Free Cash Flow Conversion calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA; Adjusted Free Cash Flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 3. FCF Yield calculated as Adjusted Free Cash Flow divided by Enterprise Value; Adjusted Free Cash Flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 0 47 76 138 8 0 221 46 0 86 49 Key Metrics Versus Selected “Locals” Comps 249 209 190 211 0 211 35 34 34 Superior Operating Metrics… …At A Meaningful Valuation Discount 0 121 59 153 12.5x 113 0 11.6x Strong 11.2% Adjusted 59 196 Highly 9.0x 8.8x 92 214 EBITDA Growth Attractive EV / 173 0 7.5x Profile Adjusted 6.8x EBITDA (19P-21P 125 245 2.5% 2.2% Multiple 174 196 Expected 211 0 CAGR) (1) 2020P 2021P 2020P 2021P 2020P 2021P 205 151 0 EV / 2020P Adjusted EV / 2021P Adjusted EBITDA EBITDA 126 153 192 90.8% 146 81.7% Superior Free Industry- 76.2% 12.1% 146 Cash Flow Leading FCF 146 8.5% Conversion Yield 6.5% (2) (3) (2020P) (2020P) 196 0 214 40 0 86 (1) (1) 255 255 199 76 0 0 Source: All Projections for Red Rock and Boyd from Capital IQ and Wall Street research as of 2/10/2020 Notes: 1. Pro forma for the expiration of the Native American Management Fee 233 117 2. Free Cash Flow Conversion calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA; Adjusted Free Cash Flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 3. FCF Yield calculated as Adjusted Free Cash Flow divided by Enterprise Value; Adjusted Free Cash Flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 0 47 76 138 8

0 221 46 0 86 49 Section 2 249 209 190 211 0 211 35 34 34 0 121 59 153 Investment 113 0 Highlights 59 196 92 214 173 0 125 245 174 196 211 0 205 151 0 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138 0 221 46 0 86 49 Section 2 249 209 190 211 0 211 35 34 34 0 121 59 153 Investment 113 0 Highlights 59 196 92 214 173 0 125 245 174 196 211 0 205 151 0 126 153 192 146 146 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 0 47 76 138

0 221 46 0 86 49 Attractive and Diverse Property Portfolio… 1 249 209 190 211 0 211 35 Recently Refreshed Properties with No Deferred Capex Spend 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 Point Edward, ON Burnaby, BC Rama, ON 174 196 211 0 205 151 0 126 153 192 146 146 New Westminster, BC Kamloops, BC Hanover, ON 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 Burnaby, BC Burnaby, BC Penticton, BC 0 47 76 138 10 0 221 46 0 86 49 Attractive and Diverse Property Portfolio… 1 249 209 190 211 0 211 35 Recently Refreshed Properties with No Deferred Capex Spend 34 34 0 121 59 153 113 0 59 196 92 214 173 0 125 245 Point Edward, ON Burnaby, BC Rama, ON 174 196 211 0 205 151 0 126 153 192 146 146 New Westminster, BC Kamloops, BC Hanover, ON 146 196 0 214 40 0 86 255 255 199 76 0 0 233 117 Burnaby, BC Burnaby, BC Penticton, BC 0 47 76 138 10

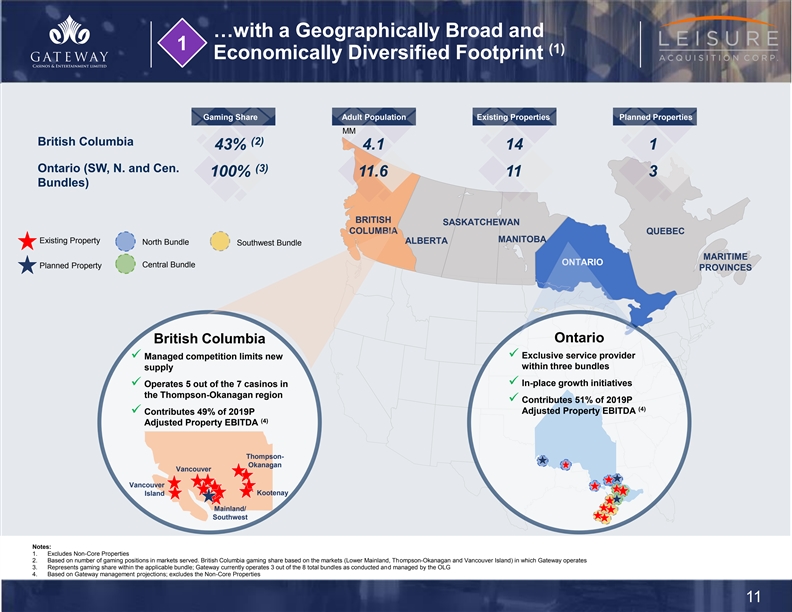

0 221 46 0 86 49 …with a Geographically Broad and 1 (1) 249 209 Economically Diversified Footprint 190 211 0 211 35 34 Gaming Share Adult Population Existing Properties Planned Properties 34 MM (2) British Columbia 43% 4.1 14 1 0 121 59 153 Ontario (SW, N. and Cen. (3) 100% 11.6 11 3 113 0 Bundles) 59 196 92 214 BRITISH SASKATCHEWAN 173 0 COLUMBIA QUEBEC MANITOBA Existing Property ALBERTA North Bundle Southwest Bundle 125 245 MARITIME ONTARIO Central Bundle 174 196 Planned Property PROVINCES 211 0 205 151 Existing Property 0 Ontario British Columbia Planned Property 126 ü Exclusive service provider ü Managed competition limits new 153 within three bundles supply 192 ü In-place growth initiatives ü Operates 5 out of the 7 casinos in the Thompson-Okanagan region 146 ü Contributes 51% of 2019P (4) 146 Adjusted Property EBITDA ü Contributes 49% of 2019P (4) 146 Adjusted Property EBITDA Thompson- 196 0 Okanagan Vancouver 214 40 Vancouver 0 86 Kootenay Island Mainland/ 255 255 Southwest 199 76 0 0 Notes: 1. Excludes Non-Core Properties 233 117 2. Based on number of gaming positions in markets served. British Columbia gaming share based on the markets (Lower Mainland, Thompson-Okanagan and Vancouver Island) in which Gateway operates 3. Represents gaming share within the applicable bundle; Gateway currently operates 3 out of the 8 total bundles as conducted and managed by the OLG 0 47 4. Based on Gateway management projections; excludes the Non-Core Properties 76 138 11 0 221 46 0 86 49 …with a Geographically Broad and 1 (1) 249 209 Economically Diversified Footprint 190 211 0 211 35 34 Gaming Share Adult Population Existing Properties Planned Properties 34 MM (2) British Columbia 43% 4.1 14 1 0 121 59 153 Ontario (SW, N. and Cen. (3) 100% 11.6 11 3 113 0 Bundles) 59 196 92 214 BRITISH SASKATCHEWAN 173 0 COLUMBIA QUEBEC MANITOBA Existing Property ALBERTA North Bundle Southwest Bundle 125 245 MARITIME ONTARIO Central Bundle 174 196 Planned Property PROVINCES 211 0 205 151 Existing Property 0 Ontario British Columbia Planned Property 126 ü Exclusive service provider ü Managed competition limits new 153 within three bundles supply 192 ü In-place growth initiatives ü Operates 5 out of the 7 casinos in the Thompson-Okanagan region 146 ü Contributes 51% of 2019P (4) 146 Adjusted Property EBITDA ü Contributes 49% of 2019P (4) 146 Adjusted Property EBITDA Thompson- 196 0 Okanagan Vancouver 214 40 Vancouver 0 86 Kootenay Island Mainland/ 255 255 Southwest 199 76 0 0 Notes: 1. Excludes Non-Core Properties 233 117 2. Based on number of gaming positions in markets served. British Columbia gaming share based on the markets (Lower Mainland, Thompson-Okanagan and Vancouver Island) in which Gateway operates 3. Represents gaming share within the applicable bundle; Gateway currently operates 3 out of the 8 total bundles as conducted and managed by the OLG 0 47 4. Based on Gateway management projections; excludes the Non-Core Properties 76 138 11

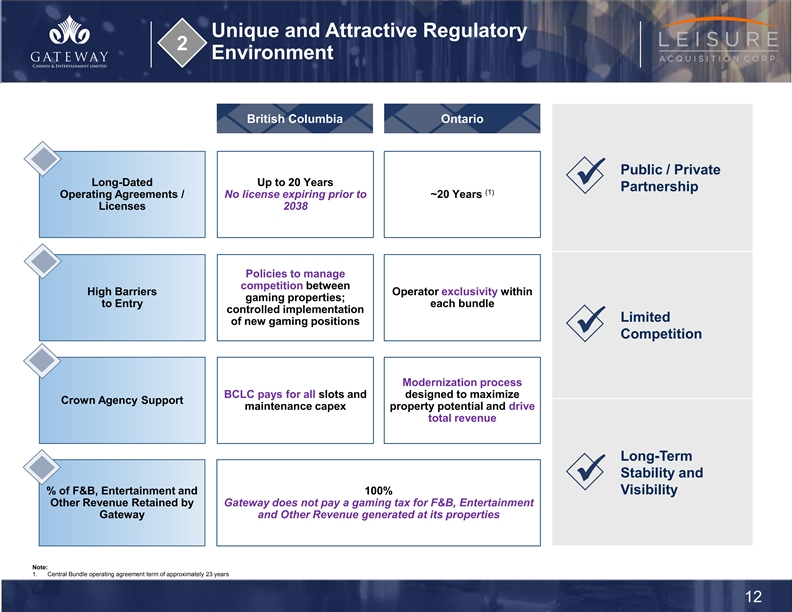

0 221 46 0 86 49 Unique and Attractive Regulatory 2 249 209 Environment 190 211 0 211 35 34 British Columbia Ontario 34 0 121 59 153 Public / Private 113 0 Long-Dated Up to 20 Years ü Partnership (1) Operating Agreements / No license expiring prior to ~20 Years 59 196 Licenses 2038 92 214 173 0 125 245 174 196 Policies to manage 211 0 competition between High Barriers Operator exclusivity within gaming properties; 205 to Entry each bundle controlled implementation 151 Limited of new gaming positions 0 ü Competition 126 153 192 Modernization process BCLC pays for all slots and designed to maximize 146 Crown Agency Support maintenance capex property potential and drive 146 total revenue 146 Long-Term 196 0 214 40 Stability and ü 0 86 Visibility % of F&B, Entertainment and 100% Other Revenue Retained by Gateway does not pay a gaming tax for F&B, Entertainment 255 255 Gateway and Other Revenue generated at its properties 199 76 0 0 233 117 Note: 0 47 1. Central Bundle operating agreement term of approximately 23 years 76 138 12 0 221 46 0 86 49 Unique and Attractive Regulatory 2 249 209 Environment 190 211 0 211 35 34 British Columbia Ontario 34 0 121 59 153 Public / Private 113 0 Long-Dated Up to 20 Years ü Partnership (1) Operating Agreements / No license expiring prior to ~20 Years 59 196 Licenses 2038 92 214 173 0 125 245 174 196 Policies to manage 211 0 competition between High Barriers Operator exclusivity within gaming properties; 205 to Entry each bundle controlled implementation 151 Limited of new gaming positions 0 ü Competition 126 153 192 Modernization process BCLC pays for all slots and designed to maximize 146 Crown Agency Support maintenance capex property potential and drive 146 total revenue 146 Long-Term 196 0 214 40 Stability and ü 0 86 Visibility % of F&B, Entertainment and 100% Other Revenue Retained by Gateway does not pay a gaming tax for F&B, Entertainment 255 255 Gateway and Other Revenue generated at its properties 199 76 0 0 233 117 Note: 0 47 1. Central Bundle operating agreement term of approximately 23 years 76 138 12

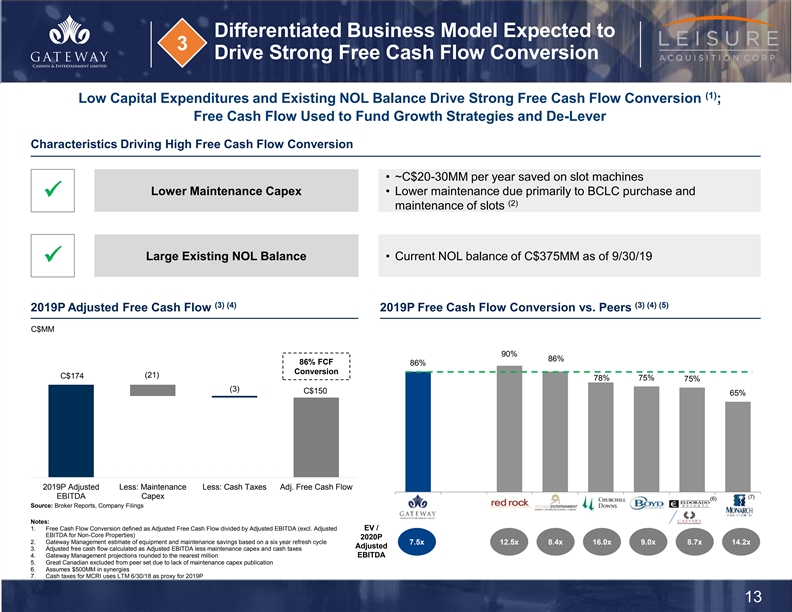

0 221 46 0 86 49 Differentiated Business Model Expected to 3 249 209 Drive Strong Free Cash Flow Conversion 190 211 0 211 (1) Low Capital Expenditures and Existing NOL Balance Drive Strong Free Cash Flow Conversion ; 35 34 Free Cash Flow Used to Fund Growth Strategies and De-Lever 34 Characteristics Driving High Free Cash Flow Conversion 0 121 59 153 • ~C$20-30MM per year saved on slot machines 113 0 Lower Maintenance Capex • Lower maintenance due primarily to BCLC purchase and ü (2) 59 196 maintenance of slots 92 214 173 0 125 245 Large Existing NOL Balance • Current NOL balance of C$375MM as of 9/30/19 ü 174 196 211 0 205 (3) (4) (3) (4) (5) 2019P Adjusted Free Cash Flow 2019P Free Cash Flow Conversion vs. Peers 151 0 C$MM 126 90% 86% 86% FCF 153 86% Conversion 192 (21) C$174 78% 75% 75% (3) C$150 65% 146 146 146 196 0 214 40 0 86 2019P Adjusted Less: Maintenance Less: Cash Taxes Adj. Free Cash Flow EBITDA Capex (7) (6) GTWY RRR GDEN CHDN BYD PF ERI MCRI Source: Broker Reports, Company Filings 255 255 199 76 Notes: 1. Free Cash Flow Conversion defined as Adjusted Free Cash Flow divided by Adjusted EBITDA (excl. Adjusted EV / 0 0 EBITDA for Non-Core Properties) 2020P 2. Gateway Management estimate of equipment and maintenance savings based on a six year refresh cycle 7.5x 12.5x 8.4x 16.0x 9.0x 8.7x 14.2x Adjusted 3. Adjusted free cash flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 4. Gateway Management projections rounded to the nearest million EBITDA 233 117 5. Great Canadian excluded from peer set due to lack of maintenance capex publication 6. Assumes $500MM in synergies 0 47 7. Cash taxes for MCRI uses LTM 6/30/18 as proxy for 2019P 76 138 13 0 221 46 0 86 49 Differentiated Business Model Expected to 3 249 209 Drive Strong Free Cash Flow Conversion 190 211 0 211 (1) Low Capital Expenditures and Existing NOL Balance Drive Strong Free Cash Flow Conversion ; 35 34 Free Cash Flow Used to Fund Growth Strategies and De-Lever 34 Characteristics Driving High Free Cash Flow Conversion 0 121 59 153 • ~C$20-30MM per year saved on slot machines 113 0 Lower Maintenance Capex • Lower maintenance due primarily to BCLC purchase and ü (2) 59 196 maintenance of slots 92 214 173 0 125 245 Large Existing NOL Balance • Current NOL balance of C$375MM as of 9/30/19 ü 174 196 211 0 205 (3) (4) (3) (4) (5) 2019P Adjusted Free Cash Flow 2019P Free Cash Flow Conversion vs. Peers 151 0 C$MM 126 90% 86% 86% FCF 153 86% Conversion 192 (21) C$174 78% 75% 75% (3) C$150 65% 146 146 146 196 0 214 40 0 86 2019P Adjusted Less: Maintenance Less: Cash Taxes Adj. Free Cash Flow EBITDA Capex (7) (6) GTWY RRR GDEN CHDN BYD PF ERI MCRI Source: Broker Reports, Company Filings 255 255 199 76 Notes: 1. Free Cash Flow Conversion defined as Adjusted Free Cash Flow divided by Adjusted EBITDA (excl. Adjusted EV / 0 0 EBITDA for Non-Core Properties) 2020P 2. Gateway Management estimate of equipment and maintenance savings based on a six year refresh cycle 7.5x 12.5x 8.4x 16.0x 9.0x 8.7x 14.2x Adjusted 3. Adjusted free cash flow calculated as Adjusted EBITDA less maintenance capex and cash taxes 4. Gateway Management projections rounded to the nearest million EBITDA 233 117 5. Great Canadian excluded from peer set due to lack of maintenance capex publication 6. Assumes $500MM in synergies 0 47 7. Cash taxes for MCRI uses LTM 6/30/18 as proxy for 2019P 76 138 13

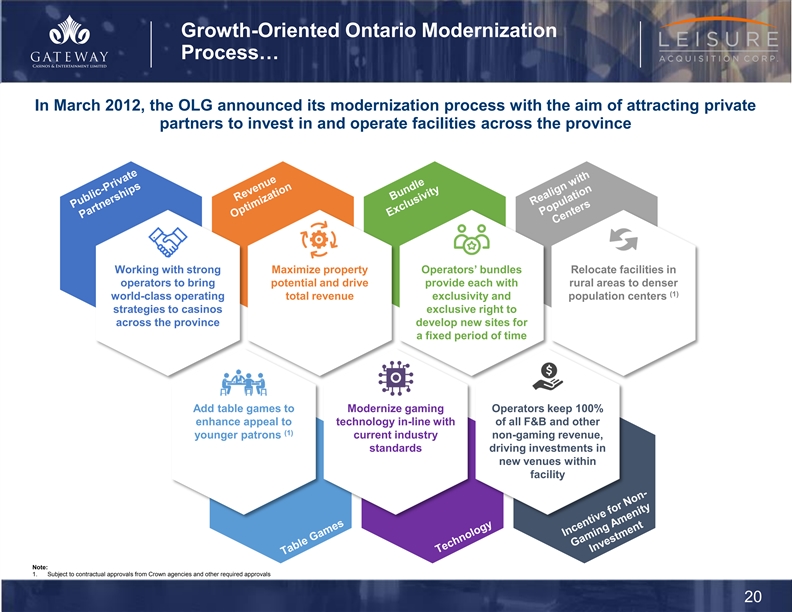

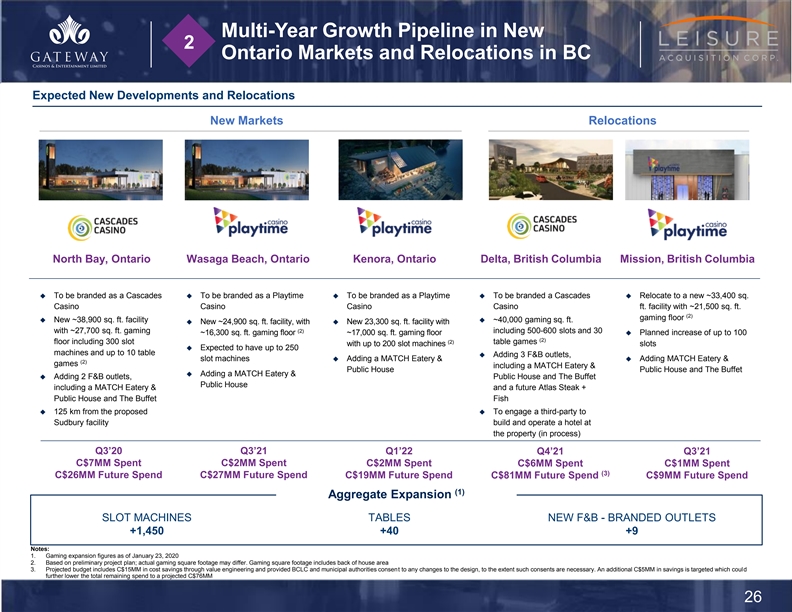

0 221 46 0 86 49 Operates in Highly Populated Markets 4 249 209 that are Relatively Underpenetrated… 190 211 0 211 35 34 34 (1)(2) (1)(2)(3) (1)(2)(4) Adult Population (MM) Adults Per Gaming Position Gaming Spend per Adult (C$) 0 121 Average of 59 153 Top 5 U.S. 6.6 134 705 113 0 Locals Driven Markets 59 196 92 214 173 0 British 125 245 4.1 248 462 174 196 Columbia 211 0 205 151 0 11.5 11.6 416 333 Ontario 126 153 192 146 146 146 ü Enormous Population Gateway ü Underbuilt Casino ü Underpenetrated Catchment Supply Player Demand Markets: 196 0 214 40 0 86 With the Recent Modernization Process, We Believe Ontario Represents the Greatest Growth 255 255 Opportunity 199 76 0 0 Notes: 1. Adult population includes individuals ages 18 years and older; population statistics as of July 1, 2018 for Canada, December 2018 for United States 233 117 2. Top 5 U.S. locals driven markets include Nevada (excluding contribution from Las Vegas strip), Pennsylvania, Louisiana, Illinois and New Jersey; Illinois data includes VGTs (video gaming terminals) and Alberta data includes VLTs (video lottery terminals) 3. Gaming positions as of 3/31/2019 for Top 5 U.S. Locals Driven Markets, Ontario and British Columbia; table games includes poker tables and assumes six gaming positions per table 0 47 4. Gaming spend is presented for the last twelve months as of March 31, 2019. U.S. gaming spend assumes an exchange rate of $1.31 per US$1, representing the average exchange rate from April 1, 2018 to March 31, 2019 76 138 14 0 221 46 0 86 49 Operates in Highly Populated Markets 4 249 209 that are Relatively Underpenetrated… 190 211 0 211 35 34 34 (1)(2) (1)(2)(3) (1)(2)(4) Adult Population (MM) Adults Per Gaming Position Gaming Spend per Adult (C$) 0 121 Average of 59 153 Top 5 U.S. 6.6 134 705 113 0 Locals Driven Markets 59 196 92 214 173 0 British 125 245 4.1 248 462 174 196 Columbia 211 0 205 151 0 11.5 11.6 416 333 Ontario 126 153 192 146 146 146 ü Enormous Population Gateway ü Underbuilt Casino ü Underpenetrated Catchment Supply Player Demand Markets: 196 0 214 40 0 86 With the Recent Modernization Process, We Believe Ontario Represents the Greatest Growth 255 255 Opportunity 199 76 0 0 Notes: 1. Adult population includes individuals ages 18 years and older; population statistics as of July 1, 2018 for Canada, December 2018 for United States 233 117 2. Top 5 U.S. locals driven markets include Nevada (excluding contribution from Las Vegas strip), Pennsylvania, Louisiana, Illinois and New Jersey; Illinois data includes VGTs (video gaming terminals) and Alberta data includes VLTs (video lottery terminals) 3. Gaming positions as of 3/31/2019 for Top 5 U.S. Locals Driven Markets, Ontario and British Columbia; table games includes poker tables and assumes six gaming positions per table 0 47 4. Gaming spend is presented for the last twelve months as of March 31, 2019. U.S. gaming spend assumes an exchange rate of $1.31 per US$1, representing the average exchange rate from April 1, 2018 to March 31, 2019 76 138 14

0 221 46 0 86 49 …and Historically Resilient 4 249 209 190 211 0 211 35 (1)(2) 34 Outperformance During Financial Crisis: Peak-to-Trough Decline 34 Canada U.S. 0 121 59 153 Total Core 5 Largest 113 0 Las Vegas British Columbia Ontario Gateway Locals-Driven Strip (3) Markets Markets Locals-Focused 59 196 ü 92 214 (0.2%) 173 0 (1.8%) 125 245 (2.5%) 174 196 211 0 205 151 0 Underpenetrated ü 126 Markets 153 192 (11.5%) 146 146 146 Diversified Across 196 0 Geographies and 214 40 (18.7%) ü 0 86 Product Offerings 255 255 199 76 0 0 Notes: 1. Peak to trough decline is calculated as the percentage change between fiscal year 2010 and fiscal year 2008 for the Canadian markets and the percent change between calendar year 2009 and calendar year 2007 for the U.S. markets. 233 117 Canadian fiscal year end is March 31 2. From 2008 to 2010, all Ontario properties were still operated by the OLG 0 47 3. Five largest locals driven markets include Nevada (excluding contribution from Las Vegas strip), Pennsylvania, Louisiana, Illinois and New Jersey. Illinois data includes Video Gaming Terminals 76 138 15 0 221 46 0 86 49 …and Historically Resilient 4 249 209 190 211 0 211 35 (1)(2) 34 Outperformance During Financial Crisis: Peak-to-Trough Decline 34 Canada U.S. 0 121 59 153 Total Core 5 Largest 113 0 Las Vegas British Columbia Ontario Gateway Locals-Driven Strip (3) Markets Markets Locals-Focused 59 196 ü 92 214 (0.2%) 173 0 (1.8%) 125 245 (2.5%) 174 196 211 0 205 151 0 Underpenetrated ü 126 Markets 153 192 (11.5%) 146 146 146 Diversified Across 196 0 Geographies and 214 40 (18.7%) ü 0 86 Product Offerings 255 255 199 76 0 0 Notes: 1. Peak to trough decline is calculated as the percentage change between fiscal year 2010 and fiscal year 2008 for the Canadian markets and the percent change between calendar year 2009 and calendar year 2007 for the U.S. markets. 233 117 Canadian fiscal year end is March 31 2. From 2008 to 2010, all Ontario properties were still operated by the OLG 0 47 3. Five largest locals driven markets include Nevada (excluding contribution from Las Vegas strip), Pennsylvania, Louisiana, Illinois and New Jersey. Illinois data includes Video Gaming Terminals 76 138 15

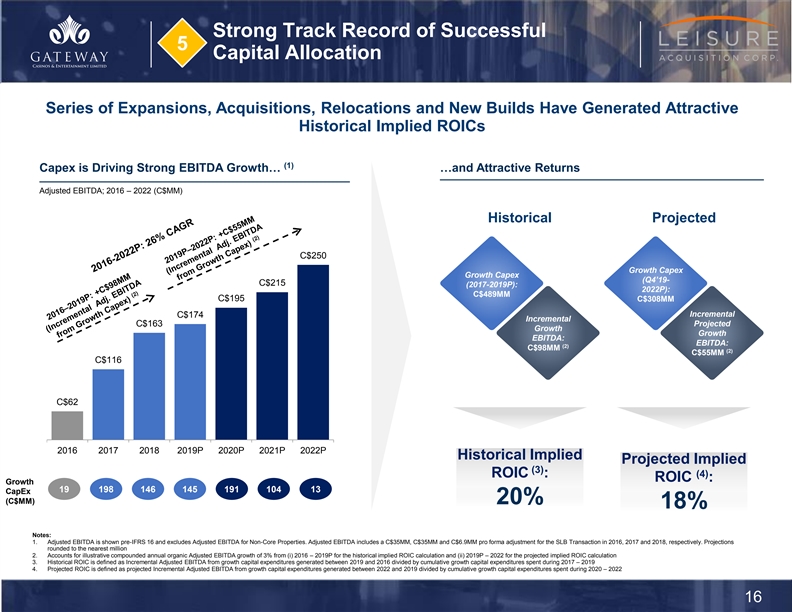

0 221 46 0 86 49 Strong Track Record of Successful 5 249 209 Capital Allocation 190 211 0 211 35 Series of Expansions, Acquisitions, Relocations and New Builds Have Generated Attractive 34 34 Historical Implied ROICs 0 121 (1) 59 153 Capex is Driving Strong EBITDA Growth… …and Attractive Returns 113 0 Adjusted EBITDA; 2016 – 2022 (C$MM) 59 196 92 214 Historical Projected 173 0 125 245 C$250 174 196 Growth Capex Growth Capex 211 0 (Q4’19- C$215 (2017-2019P): 2022P): C$489MM C$195 C$308MM 205 Incremental C$174 151 Incremental Projected C$163 0 Growth Growth EBITDA: EBITDA: (2) C$98MM (2) 126 C$55MM C$116 153 192 146 C$62 146 146 Grand Villa Edmonton 2016 2017 2018 2019P 2020P 2021P 2022P Cascades North Bay Historical Implied 196 Projected Implied 0 (3) 214 40 (4) ROIC : ROIC : Growth 0 86 19 198 146 145 191 104 13 CapEx (C$MM) 20% 18% 255 255 199 76 0 0 Notes: 1. Adjusted EBITDA is shown pre-IFRS 16 and excludes Adjusted EBITDA for Non-Core Properties. Adjusted EBITDA includes a C$35MM, C$35MM and C$6.9MM pro forma adjustment for the SLB Transaction in 2016, 2017 and 2018, respectively. Projections rounded to the nearest million 2. Accounts for illustrative compounded annual organic Adjusted EBITDA growth of 3% from (i) 2016 – 2019P for the historical implied ROIC calculation and (ii) 2019P – 2022 for the projected implied ROIC calculation 233 117 3. Historical ROIC is defined as Incremental Adjusted EBITDA from growth capital expenditures generated between 2019 and 2016 divided by cumulative growth capital expenditures spent during 2017 – 2019 4. Projected ROIC is defined as projected Incremental Adjusted EBITDA from growth capital expenditures generated between 2022 and 2019 divided by cumulative growth capital expenditures spent during 2020 – 2022 0 47 76 138 16 0 221 46 0 86 49 Strong Track Record of Successful 5 249 209 Capital Allocation 190 211 0 211 35 Series of Expansions, Acquisitions, Relocations and New Builds Have Generated Attractive 34 34 Historical Implied ROICs 0 121 (1) 59 153 Capex is Driving Strong EBITDA Growth… …and Attractive Returns 113 0 Adjusted EBITDA; 2016 – 2022 (C$MM) 59 196 92 214 Historical Projected 173 0 125 245 C$250 174 196 Growth Capex Growth Capex 211 0 (Q4’19- C$215 (2017-2019P): 2022P): C$489MM C$195 C$308MM 205 Incremental C$174 151 Incremental Projected C$163 0 Growth Growth EBITDA: EBITDA: (2) C$98MM (2) 126 C$55MM C$116 153 192 146 C$62 146 146 Grand Villa Edmonton 2016 2017 2018 2019P 2020P 2021P 2022P Cascades North Bay Historical Implied 196 Projected Implied 0 (3) 214 40 (4) ROIC : ROIC : Growth 0 86 19 198 146 145 191 104 13 CapEx (C$MM) 20% 18% 255 255 199 76 0 0 Notes: 1. Adjusted EBITDA is shown pre-IFRS 16 and excludes Adjusted EBITDA for Non-Core Properties. Adjusted EBITDA includes a C$35MM, C$35MM and C$6.9MM pro forma adjustment for the SLB Transaction in 2016, 2017 and 2018, respectively. Projections rounded to the nearest million 2. Accounts for illustrative compounded annual organic Adjusted EBITDA growth of 3% from (i) 2016 – 2019P for the historical implied ROIC calculation and (ii) 2019P – 2022 for the projected implied ROIC calculation 233 117 3. Historical ROIC is defined as Incremental Adjusted EBITDA from growth capital expenditures generated between 2019 and 2016 divided by cumulative growth capital expenditures spent during 2017 – 2019 4. Projected ROIC is defined as projected Incremental Adjusted EBITDA from growth capital expenditures generated between 2022 and 2019 divided by cumulative growth capital expenditures spent during 2020 – 2022 0 47 76 138 16